Saudi Arabian banks are starting to show signs of pulling back on lending for the first time in years as liquidity tightness and new bank regulations make it more challenging to keep up with demand for credit.

Medium-term lending by local banks fell 5% in the third quarter, the first quarterly drop since 2022, according to data compiled by Bloomberg. That marks the initial signs of easing after years of explosive growth that took volumes to a record in June.

A bigger pullback now beckons as banks contend with strong economic momentum, slower deposit growth and regulations that’ll soon require more capital to be held on balance sheets, according to Moody’s Ratings.

“Banks are becoming more selective,” said Ashraf Madani, vice president and senior credit officer at the firm. “Now, banks are getting 10 applications, they’re giving back seven loans.” He expects more caution ahead that will eventually lead to less loan generation and an easing in banks’ loan-to-deposit ratios from 115% this year.

Lenders are facing increasing challenges as economic players from government entities to corporates look to drive the Vision 2030 agenda. That plan aims to build up new industries from finance to artificial intelligence to make the economy less reliant on oil and transform Riyadh into a global hub for investment.

With the government running sustained budget deficits, the sovereign wealth fund weighing new spending priorities and debt capital markets still under development, banks have become the primary source of financing for those plans. Lenders have increased their own borrowing to meet appetite for loans, issuing debt at both the senior and junior levels.

Adding to their challenges are Saudi central bank regulations that will increase capital requirements by 1% in mid-2026.

Junaid Ansari, director of investment strategy and research at Kamco Investment Company, said the impact “should be manageable,” while Moody’s sees the requirements pressuring balance sheets and accelerating the lending slowdown.

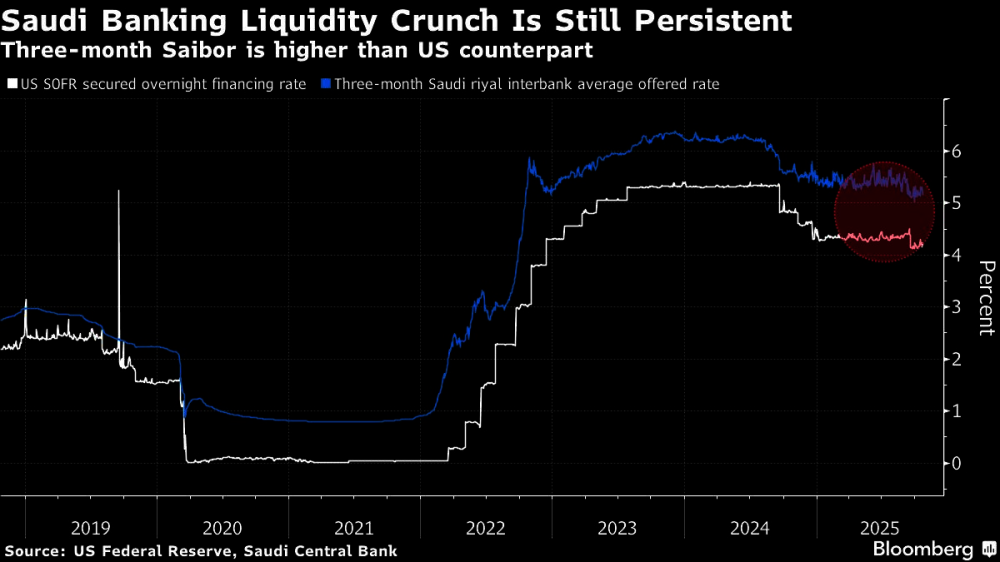

Edmond Christou, senior industry analyst at Bloomberg Intelligence, notes its 2025 consensus forecast for 13% Saudi loan growth is at risk of missing the mark. While interest rate cuts may help, the benefits may be outweighed by tight liquidity.

To be sure, there are still plenty of signs of robust growth, with both short- and long-term credit facilities still expanding in the third quarter.

Al Rajhi Bank said it expects moderate expansion in the final stretch of the year despite challenges, while SNB and Riyad Bank have noted they are starting to lend more selectively.

Medium-term lending by local banks fell 5% in the third quarter, the first quarterly drop since 2022, according to data compiled by Bloomberg. That marks the initial signs of easing after years of explosive growth that took volumes to a record in June.

A bigger pullback now beckons as banks contend with strong economic momentum, slower deposit growth and regulations that’ll soon require more capital to be held on balance sheets, according to Moody’s Ratings.

“Banks are becoming more selective,” said Ashraf Madani, vice president and senior credit officer at the firm. “Now, banks are getting 10 applications, they’re giving back seven loans.” He expects more caution ahead that will eventually lead to less loan generation and an easing in banks’ loan-to-deposit ratios from 115% this year.

Lenders are facing increasing challenges as economic players from government entities to corporates look to drive the Vision 2030 agenda. That plan aims to build up new industries from finance to artificial intelligence to make the economy less reliant on oil and transform Riyadh into a global hub for investment.

With the government running sustained budget deficits, the sovereign wealth fund weighing new spending priorities and debt capital markets still under development, banks have become the primary source of financing for those plans. Lenders have increased their own borrowing to meet appetite for loans, issuing debt at both the senior and junior levels.

Adding to their challenges are Saudi central bank regulations that will increase capital requirements by 1% in mid-2026.

Junaid Ansari, director of investment strategy and research at Kamco Investment Company, said the impact “should be manageable,” while Moody’s sees the requirements pressuring balance sheets and accelerating the lending slowdown.

Edmond Christou, senior industry analyst at Bloomberg Intelligence, notes its 2025 consensus forecast for 13% Saudi loan growth is at risk of missing the mark. While interest rate cuts may help, the benefits may be outweighed by tight liquidity.

To be sure, there are still plenty of signs of robust growth, with both short- and long-term credit facilities still expanding in the third quarter.

Al Rajhi Bank said it expects moderate expansion in the final stretch of the year despite challenges, while SNB and Riyad Bank have noted they are starting to lend more selectively.