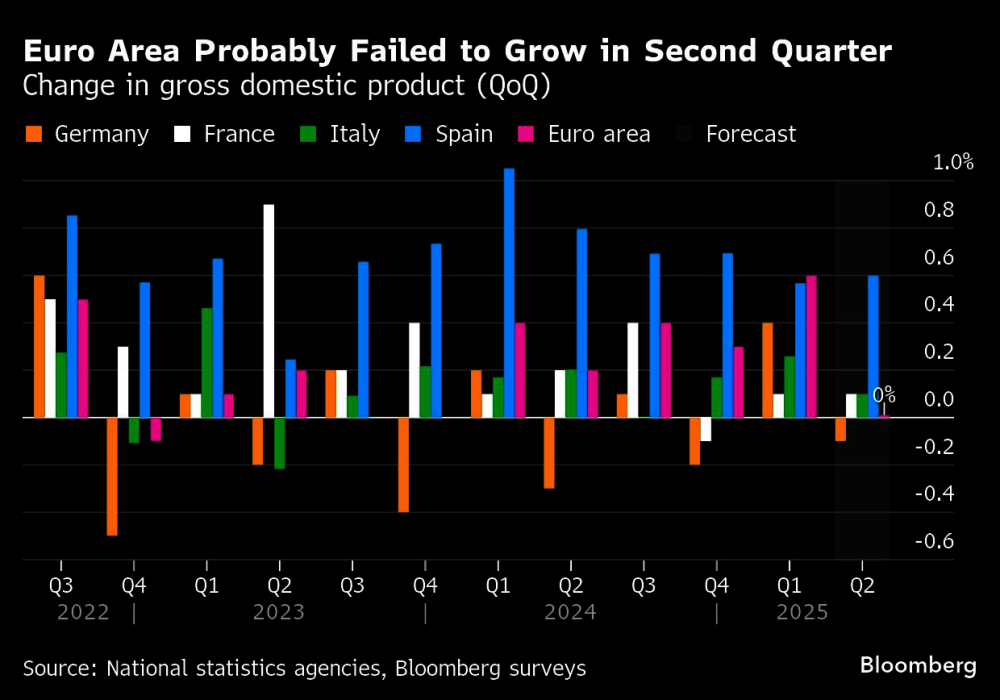

Key euro-area output data next week are expected to show the economy stagnated in the second quarter, the flipside of tariff-related frontloading that provided an temporary boost at the start of the year.

Economists in a Bloomberg poll expect Wednesday’s figures to show gross domestic product remained flat in the three months through June, after 0.6% expansion in the first quarter. That performance was lifted by a sudden increase in trade — particularly visible in Irish figures — before Donald Trump’s expected announcement of global import duties.

“A reversal of this effect is likely to weigh on growth,” said Simona Delle Chiaie, chief euro-area economist at Bloomberg Economics. “This drag adds to a softer domestic backdrop, with elevated uncertainty holding back household spending and business investment.”

Among the bloc’s biggest economies, Germany is forecast to see the worst performance with output slipping 0.1% from the previous quarter. Spain is expected to keep growing by 0.6%, with France and Italy expanding just slightly.

While the numbers will be watched closely, the future development of the 20-nation bloc depends greatly on whether the European Union can strike a deal with the US that avoids the harshest tariffs threatened by Trump. Reports this week suggested negotiators are closing in on a deal that would set them at 15% — a scenario that German exporters “could live with,” according to Ifo President Clemens Fuest.

European Central Bank President Christine Lagarde also highlighted the economy’s resilience after policymakers held interest rates steady for the first time in a year. While she acknowledged that frontloading played a role, she also cited “increased consumption and increased investment.”

Meanwhile, inflation data for the bloc on Friday is set to confirm the ECB’s confidence that it’s been brought under control. Consumer prices are forecast to have risen 1.9% in July, less than the previous month’s 2% and just below the central bank’s goal. A measure of underlying inflation probably remained steady, at 2.3%.

The ECB predicts inflation will meet its 2% target in the medium term following an extended dip below that threshold. A threat to that view is the strength of the euro, which could put further downward pressure on import costs and make exports less competitive.

A detrimental trade deal with the US would probably also result in weaker inflation, though it depends on how the EU would respond. ECB officials hope to have more clarity at their September meeting, when a new set of projections would allow them to assess a potential agreement.

In an interview published yesterday, ECB Executive Board member Piero Cipollone said the economy is sending “conflicting signals.”

“In September – and later this year – we will have more information, which will feed into revised macroeconomic projection,” he told Slovenia’s Delo. “We will need to see how prices in the euro area are affected by trade disruptions – including their impact on supply chains as well as on trade diversion that is already resulting in higher euro area imports from China.”