China’s long-awaited stimulus measures may have been too much for the markets to handle.

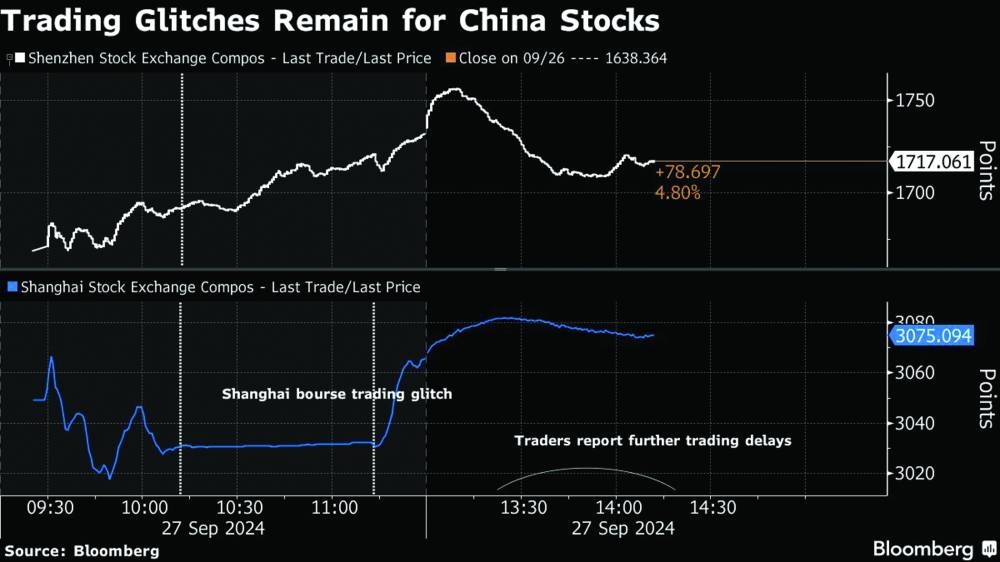

With shares soaring and turnover reaching 710bn yuan ($101bn) in the first hour of trading on Friday, Shanghai’s stock exchange was marred by glitches in processing orders and delays, according to messages from brokerages seen by Bloomberg News. The Shanghai Stock Exchange is investigating reasons for delays, it said in a statement.

The Shanghai Composite Index stayed roughly unchanged from 10.10am for about an hour even as the Shenzhen composite gained 4.4% over the period. As trading resumed, the Shanghai index surged.

Some continued to experience delays in getting orders through in the afternoon session, multiple traders told Bloomberg News. Onshore turnover was fairly muted after 1pm local time.

“I only recall a trading delay like this one during the 2015 rally, but generally it sends a positive signal,” said Du Kejun, fund manager at Shandong Camel Asset Management Co. “While it was but a small disruption to our trading, it would have been a big annoyance for firms that were eager to increase their positions today.” China’s stock markets erased losses for the year, following a blitz of stimulus measures introduced this week. That has sparked a frenzy of trading, with the volume turnover nearing 1tn yuan in the morning session. That’s more than the total for a full day seen in recent months.

Investors are rushing in amid a fear of missing out as China’s most daring policy campaigns in decades sparked a rally of about 15% in the onshore benchmark this week.

That makes this five-day period through Friday the busiest prior to a national day holiday on record.

The Politburo, comprising the ruling Communist Party’s 24 most-senior officials including President Xi Jinping, vowed to strengthen fiscal and monetary policies and pledged to “strive to achieve” the annual goal, according to a Thursday statement. They also committed to action to make the property sector “stop declining,” their strongest vow yet to stabilize the crucial industry.

“The trading system is simply overwhelmed. There is a huge stampede of stock bulls.” Hao Hong, chief economist at Grow Investment Group, said in a post on X.

An investor looks at his mobile phone in front of a board showing stock information at a brokerage office in Beijing