When Opec+ ministers take stock of global oil markets next week, they’ll see plenty of evidence that their production cuts are working.

After a subdued start to the year, crude prices are showing increasing signs of life as the supply reductions by Saudi Arabia and its allies combine with surprisingly resilient demand.

Market sentiment still lacks the exuberance of early 2023, when traders widely proclaimed the return of $100 oil, but Wall Street banks like Morgan Stanley and trading giants such as Trafigura Group are predicting further price gains.

Brent crude futures have climbed about 11% this year, cementing a floor above $85 a barrel in recent weeks. While that may aggravate central banks and consumers by undercutting recent success in the fight against inflation, for Riyadh and its partners the rally shores up vital revenue.

Officials from the Organisation of Petroleum Exporting Countries see no need to consider any changes to production policy on April 3, when they’ll hold an online review of the latest output cutbacks.

“The Opec cuts have been effective,” said Michael Hsueh, a strategist at Deutsche Bank AG. “The global market is either already in deficit or on the verge of turning into deficit.”

The past few weeks have brought plenty of validation that the cuts are having the desired effect, Opec+ delegates said.

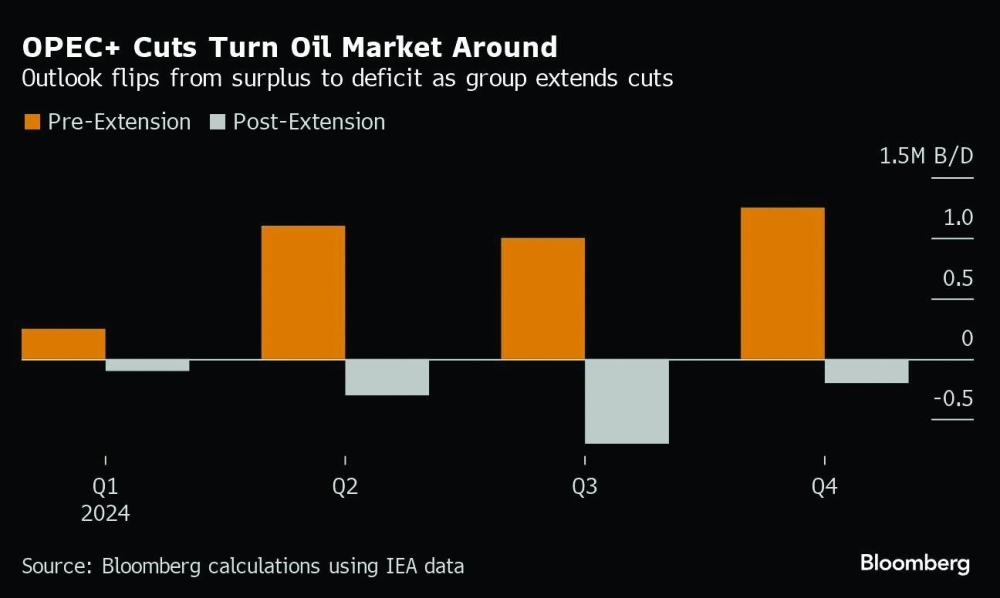

The International Energy Agency, which advises major economies, flipped its outlook for global markets in 2024 from a supply surplus to a deficit following the alliance’s decision to extend its curbs to the end of June. Global fuel consumption is surpassing expectations and the Opec+ cuts — amounting to roughly 2mn barrels a day — are offsetting a flood of new oil from across the Americas, the IEA said.

At the oil industry’s annual get-together in Houston earlier this month, the CERAWeek by S&P Global conference, the mood among executives was bullish.

Top trader Gunvor Group Ltd forecast a rally toward $90 a barrel, and Trafigura said the focus for prices has shifted to “upside risk.” The duo see world consumption growing by roughly 1.5mn barrels a day this year, above historic trends, as robust US consumption offsets slower growth in China.

On Wall Street, Morgan Stanley has bolstered its crude price forecasts, and JPMorgan Chase & Co warned that Brent may hit $100 a barrel, assuming Russia follows through on its new pledge to shift the emphasis of its cuts from exports to production.

World oil inventories drained at a rapid clip of 1.7mn barrels a day last month, Standard Chartered Plc estimates.

Rising prices may spell pain for consumers. US gasoline prices at the pump are likely to climb to $4 a gallon, the highest since the summer of 2022, according to the AAA automobile club. That could complicate the work of the Federal Reserve as it seeks to pivot to looser monetary policy. It may also spell trouble for President Joe Biden as he begins his reelection campaign against Donald Trump, with high inflation still fresh in consumers’ minds.

“President Biden faces the prospect of a cruel summer,” with conflicts in Ukraine and the Middle East imperilling energy supplies, said Helima Croft, head of global commodity strategy at RBC Capital Markets LLC.

But for the 22 members of Opec+, the price upturn helps fill government coffers.

Saudi Arabia wants oil prices above $90 a barrel, according to Fitch Ratings, as Crown Prince Mohamed bin Salman spends on everything from futuristic cities to premier sports players. President Vladimir Putin’s Russia, meanwhile, needs funds to continue waging war on Ukraine.