US economic growth was stronger than expected in the final months of 2023, government data showed Thursday, offering a boost to President Joe Biden as he heads into reelection campaigning.

The world’s biggest economy expanded at an annualised rate of 3.3% in the fourth quarter, fuelled by a resilient jobs market and consumer spending, the Commerce Department said.

Compared to the same period a year prior, fourth quarter growth was 3.1%.

Meanwhile, full-year growth accelerated to 2.5%, from 1.9% in 2022.

Biden, who is aiming to convince voters that he has done a good job reining in costs while spurring investments to support the economy, welcomed the news.

“Wages, wealth, and employment are higher now than they were before the pandemic,” he said in a statement.

“That is three years in a row of growing the economy from the middle out and the bottom up on my watch,” he added, conceding his work is not done in battling to lower prices.

The latest data strengthens optimism that the US is achieving a “soft landing,” where inflation comes down on the back of higher interest rates, without triggering a damaging recession.

The fourth quarter GDP jump “reflected increases in consumer spending, exports, state and local government spending” and other areas, said the Commerce Department.

In early 2023, analysts expected consumer spending to lose steam as households drew down on accumulated savings during the Covid-19 pandemic and as borrowing costs stayed high.

Some warned that the country could enter a recession, but growth has been supported by surprising labour market strength, with low unemployment even as hiring starts to cool.

“Economic growth has been more resilient than we anticipated going into 2023,” Nationwide chief economist Kathy Bostjancic told AFP.

“The largest surprise was the ongoing strength in the labour market, which fuelled robust job and wage gains,” she added.

Bolstered personal incomes in turn helped to support consumption.

But the economy is not out of the woods yet, given that employment growth in some sectors has weakened and interest rates remain at a 22-year high.

“We still expect the economy to grow in 2024, but at a slower pace,” Bernard Yaros of Oxford Economics told AFP.

“As long as the labour market holds it together and unemployment drifts only gradually higher, the consumer will continue to power this expansion,” he added.

Residential investment is also likely to be a bigger factor behind growth, with the Federal Reserve expected to lower interest rates and homebuilders set to capitalise on lower mortgage rates and a frozen existing-home market, Yaros said.

The outlook for first quarter GDP now is “for a moderate slowing” from the fourth quarter, said Pantheon Macroeconomics chief economist Ian Shepherdson in a note.

“But we see few signs that the economy is about to roll over, and housing investment — the most interest-rate sensitive sector — is starting to recover,” he added.

Although the Fed’s longer-run GDP growth projection is 1.8%, the latest data may not stop policymakers from cutting rates as soon as in May or June.

“Inflation will be the key determinant of the timing and degree of Fed easing this year,” Bostjancic said.

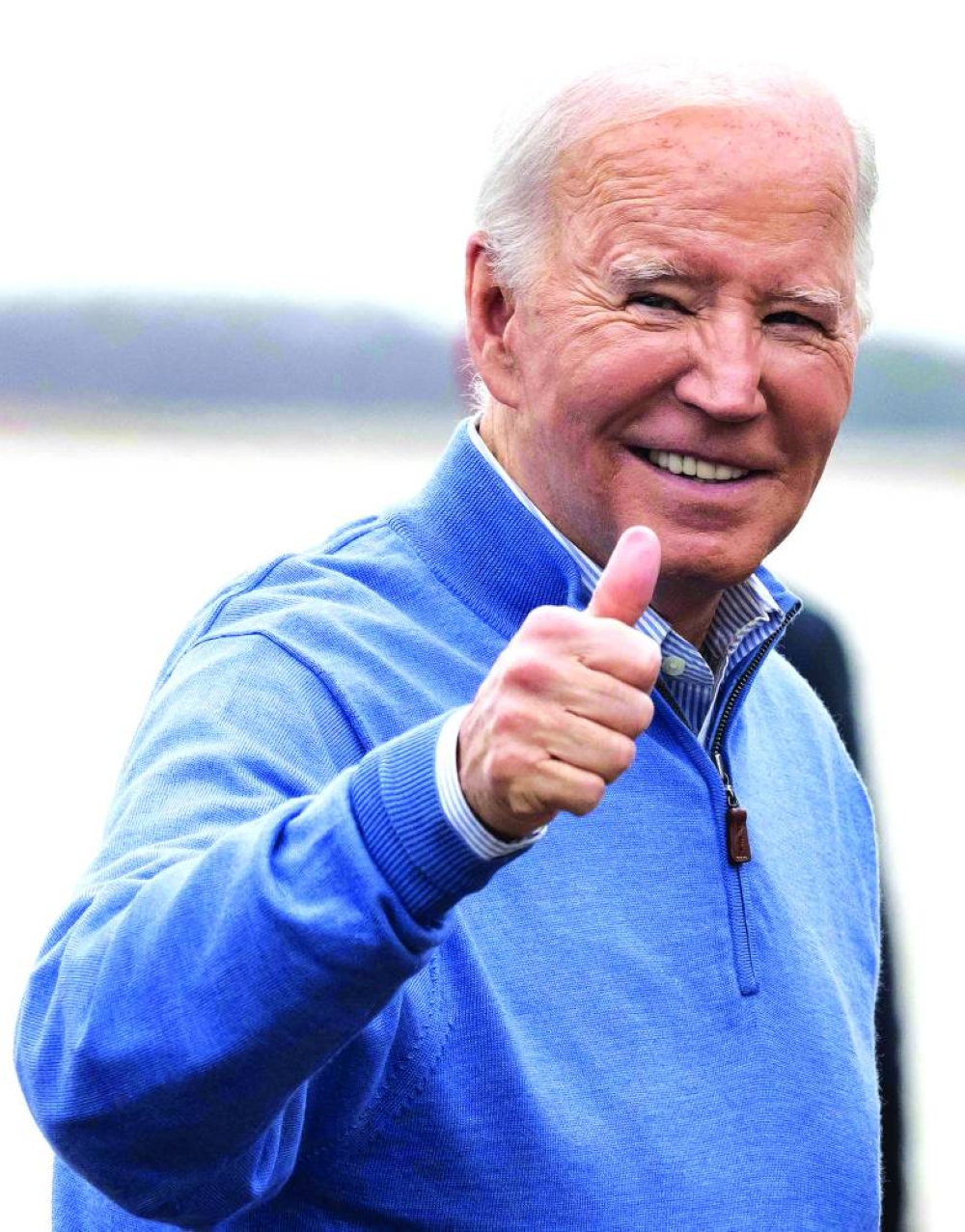

US President Joe Biden arrives to board Air Force One at Joint Base Andrews in Maryland on Thursday. US economic growth was stronger than expected in the final months of 2023, government data showed Thursday, offering a boost to President Joe Biden as he heads into reelection campaigning.