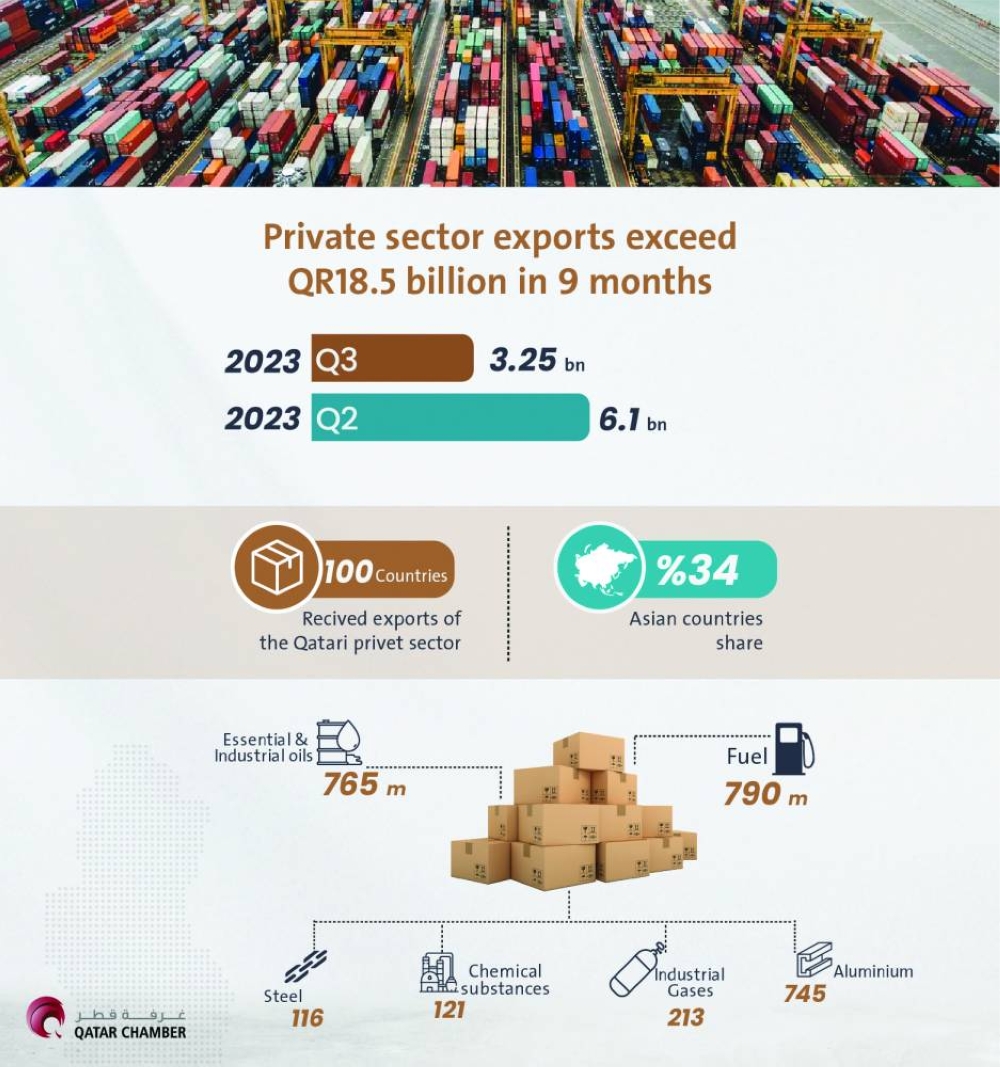

The country’s private sector exports exceeded QR18.5bn in the first nine months of 2023, Qatar Chamber has reported in its latest report.

Based on the certificates of origin issued by the chamber, private sector exports in Q3 2023 (July to September) stood at QR3.25bn. Year-on-year, the amount reflects a 65% decrease from QR9.3bn. Quarterly, this shows a 47% decline from QR6.1bn in Q2 2023.

According to the quarterly report issued yesterday by Qatar Chamber, private sector exports value in Q3 2023, the largest value of exports, was through the General Model by 65%, followed by the GCC Model by 19%, the Unified Arab Model by 12%, and the Unified Singapore by 5%. No exports were registered through the Agricultural & Livestock Model, while exports through the GSP Model were suspended.

The report highlighted a decline in export values for most of the 10 commodity groups in Q3 2023 compared to the previous quarter. Notably, aluminium exports increased by 5%, steel exports (158%), and chemical fertilisers (0.6%).

Conversely, other commodity groups recorded negative values compared to both the corresponding and preceding quarters. Exports of fuel commodities declined by 54%, base oils and industrial oils (69%), chemicals (14%), paraffin (40%), and lotrene (15%).

These 10 commodity groups collectively represented about 90% of the total value of private sector exports during Q3 2023.

The chamber also reported that based on the types of certificates of origin, the Asian countries' bloc (excluding GCC and Arab countries) ranked at the top of the economic blocs with a share of 34.6% of the total exports. Following closely is the group of EU states with a share of 27.3% and the group of GCC states with a share of 22.6%.

In fourth place is the group of Arab countries, excluding GCC states, with a share of 12.7%, followed by US exports with a share of 1.7%, and the grouping of African Countries, excluding Arab countries, which came in sixth place, receiving 0.7% of the total exports.

This is followed by the group of Other American Countries with a share of 0.16%, the grouping of Oceania countries with exports amounting to 0.15% of the total exports, and other European countries, which received exports represented a share of 0.07%.

In Q3 2023, the Netherlands was at the top of the countries of destination of private sector exports with a share of 15.5% of the total exports, followed by Oman with 12.5%, and Singapore (8.9%). India came in fourth place with 8.9% and the UAE (7.4%) followed by China (5.9%), Tunisia (5.3%), Germany (4.8%), Turkiye (3.4%), and France (3.3%).

Together, these 10 countries accounted for 76% of the total value of private sector exports as per certificates, while 90 countries received a share of 24% of the total value of private sector exports.

According to the types of certificates of origin, the decrease in the total value of exports is attributed to a decline in all certificate models, except for exports through the Unified Arab Model, which amounted to QR381.41mn in Q3, marking a 3% increase compared to Q2 (QR369.95mn).

However, the value of exports through the General Model in Q3 amounted to QR2,107.64mn, indicating a 49% decrease compared to Q2 (QR4,114.80mn). Exports through the GCC Model decreased by 49% compared to Q2. Exports through the Singapore Model amounted to QR147.31mn, reflecting a 65% decrease, while no exports were registered through the Agricultural & Livestock Model and the GSP Model.

According to the report, 100 countries received Qatari exports in Q3 distributed among the above economic groupings. The African grouping topped the list with 24 countries, followed by Asia with 21, the EU (18), and Arab countries, excluding GCC states, (13), other American countries (9), other European countries (7), the GCC (5), and two countries in the Oceania grouping and the US.