Qatar is contemplating legal recognition of digital assets as part of efforts to put in place legislation for a tokenisation framework.

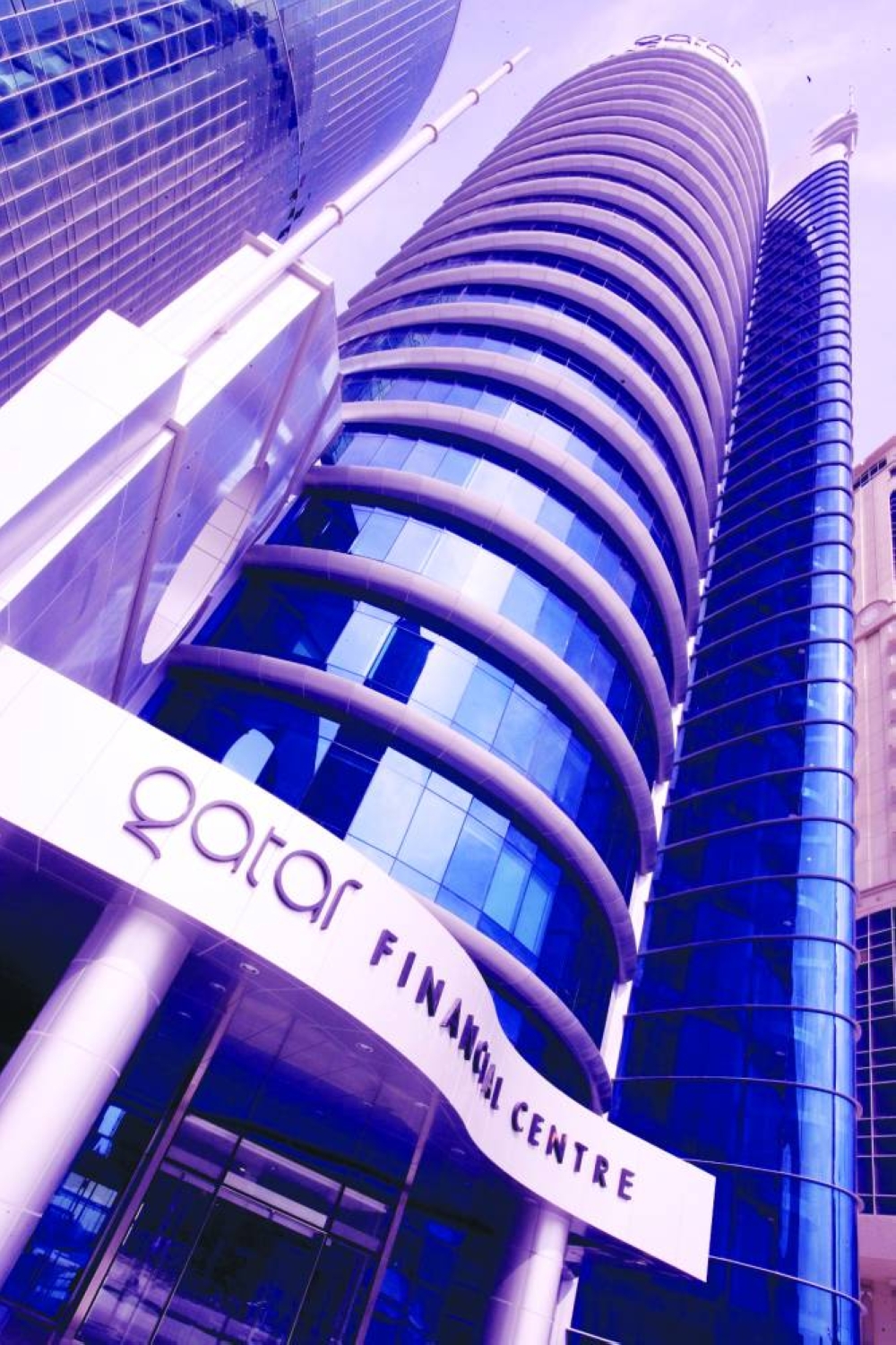

In this regard, the Qatar Financial Centre Regulatory Authority (QFCRA) and QFC Authority (QFCA) have jointly developed a QFC digital assets framework. The proposals support Qatar’s digital economy strategy and the continued development of the QFC as a leading financial and business centre in the Middle East.

Both QFCRA and QFCA seek public comments from firms and industry practitioners on the structure, content, and practitioner usability of the proposed framework. The deadline to submit the responses is January 2, 2024.

The framework is designed to develop a legal and regulatory framework for digital assets through the establishment of a tokenisation framework in the QFC that will provide legal certainty and a trusted technology environment for digital assets.

It seeks to provide legal recognition of digital assets and address issues such as ownership of the underlying assets, custody arrangements, the transfer of ownership, trading and exchange of digital assets and smart contracts.

Through this framework, the QFC aims to develop a trusted technology infrastructure that embeds the standards necessary to ensure trust and confidence among consumers and support for the framework from high quality service providers.

It aims to develop a framework that delivers certainty and promotes trust and confidence in digital assets, the market, and the service providers.

In developing the proposed framework, the QFCRA and the QFCA have considered a range of legal and regulatory benchmark jurisdictions.

These include Lichtenstein, Switzerland, the European Union, the Monetary Authority of Singapore, various state and offshore financial centre frameworks in the Gulf Co-operation Council (GCC) and other benchmark regulatory jurisdictions.

In support of the development of the proposed framework, the QFCA has also established an advisory group of industry practitioners across various disciplines to provide feedback on the legal framework and offer potential use cases.

The proposed digital assets framework is being developed on a phased basis with the first phase focusing on the establishment of legislation to provide for a QFC tokenisation framework. It is envisaged that subsequent phases will focus on building out the detailed regulatory framework for specific activities and products.

The proposed rules primarily make provision for the treatment of tokens, representing underlyings that are specified products under the QFC financial services regulations.

The proposed regulations establish the concept of tokens and what constitutes a permitted token. The regulations also contain provisions relating to transfer of tokens, token ownership, and rights in the underlying and various definitions for the types of token service providers that will be subject to the proposed licensing framework in the QFC.

Following the Qatar Central Bank’s prohibition on cryptocurrencies in the Circular 6 of 2018 and communication issued by the QFCRA in that regard, cryptocurrencies and similar digital assets are excluded from the proposed draft digital asset regulations 2023.

The QFC’s digital assets framework proposals support Qatar’s digital economy strategy and the continued development of the QFC as a leading financial and business centre in the Middle East.