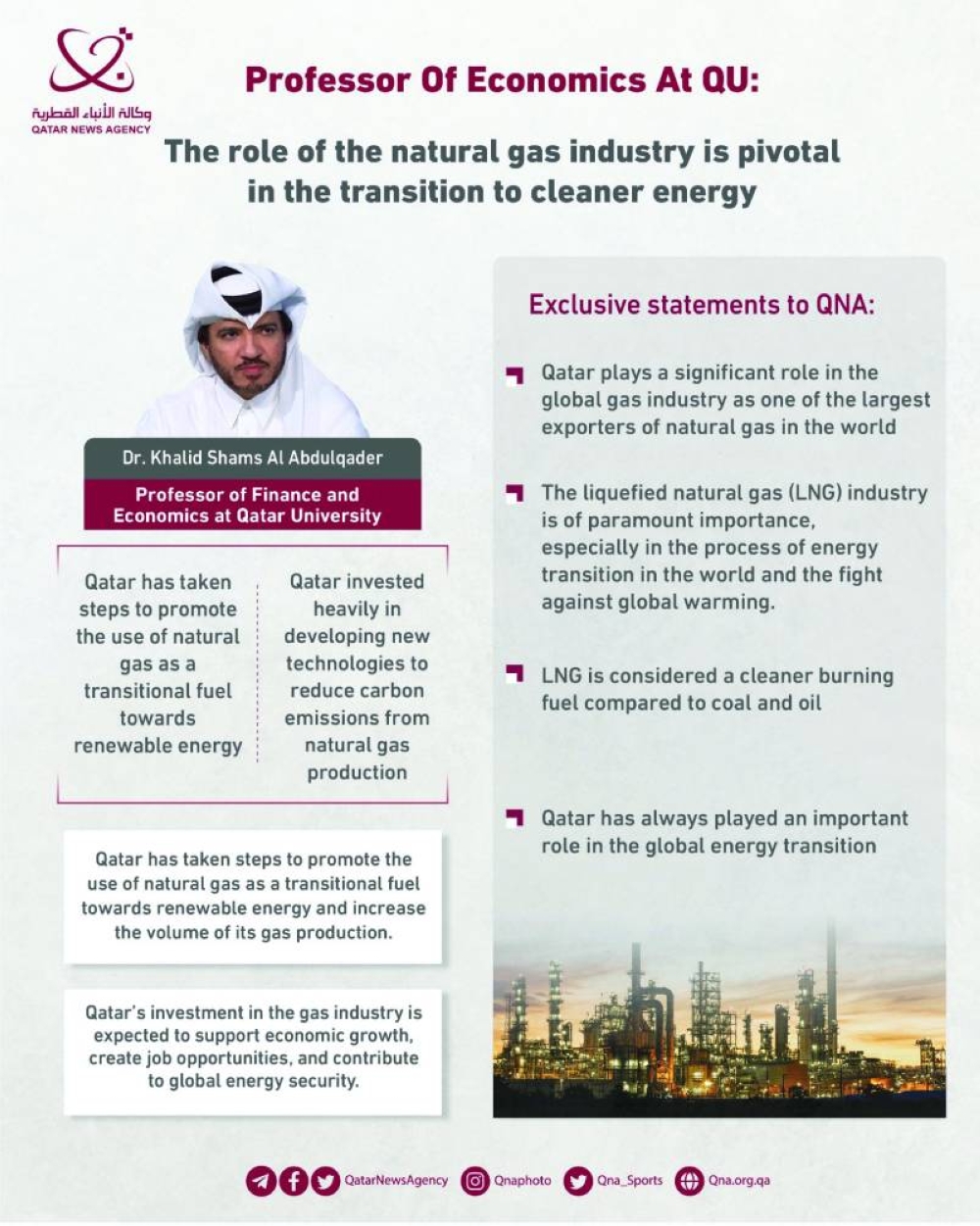

Professor of Finance and Economics at Qatar University, Dr Khalid Shams al-Abdulqader, affirmed the role played by the State of Qatar in the global gas industry as one of the largest exporters of natural gas in the world, pointing out to its support for global economic growth in light of the transformations taking place in the sector.

Dr Khalid al-Abdulqader said in remarks to Qatar News Agency (QNA) that the liquefied natural gas (LNG) industry is of paramount importance, especially in the process of energy transition in the world and the fight against global warming, as LNG is considered a cleaner burning fuel compared to coal and oil.

The finance and economics professor pointed out that the gas industry in Qatar has always played an important role in the global energy transition, as many countries are looking to shift from fossil fuels to cleaner and more sustainable energy sources.

He noted that Qatar has taken steps to promote the use of natural gas as a transitional fuel towards renewable energy, and has invested heavily in developing new technologies to reduce carbon emissions from natural gas production.

In recent years, Qatar has continued to invest in its gas industry, with plans to increase its LNG production capacity and expand its global market share, he added.

Qatar is expected to increase the volume of its gas production to 126mn tonnes in 2026, compared to 77mn tonnes currently, which is equivalent to doubling production by an estimated 66%, which will enable Qatar to produce 13mn barrels per day instead of the current 12mn barrels, while QatarEnergy has signed a number of contracts to expand the northeastern and southern gas fields.

In the same context, Dr Khalid Shams al-Abdulqader added that the state's investment in the gas industry is expected to support economic growth, create job opportunities, and contribute to global energy security. Looking to the future, Qatar's gas industry is well positioned to continue to play an important role in the global energy transition.

He added that as more countries look to reduce their dependence on fossil fuels and shift to cleaner energy sources, it is likely that the demand for natural gas will increase, and the gas industry in Qatar is likely to benefit from this trend, especially the importance of transporting liquefied gas, in which the State of Qatar specializes and can transport it to any part of the world under all circumstances, including the current circumstance that has placed some countries, especially European ones, in dire need of Qatari gas.

He stated that Qatar's focus on developing new technologies to reduce carbon emissions from natural gas production could help putting the country in a leading position in the transition to a low-carbon economy, which enhances its role in preserving the environment and achieving sustainability in the future.

Commenting on the role of the energy sector in driving economic growth at the international level, the professor of finance and economics at Qatar University considered that oil and energy prices generally have a significant impact on global economic growth, because oil is an important component of many services and industries, especially transportation and manufacturing.

He said that in general, the oil market is an important factor that must be taken into account when studying global economic growth. It can have both positive and negative impacts on various industries and economies around the world, adding that when the price of oil rises, the cost of producing and transporting goods also increases, which may lead to higher prices for consumers and to economic inflation and then raise interest rates, as is happening today. The opposite effect of higher oil prices is that it may in turn lead to lower demand for goods and services, which may slow economic growth.

Dr Khalid indicated that oil-exporting countries often rely heavily on oil revenues to finance their economies. Oil price fluctuations can have a significant impact on their budgets, adding that if oil prices fall, these countries may have less money to invest in infrastructure, social programs and other initiatives that support economic growth. On the other hand, when oil prices are low, it can be beneficial for oil-importing countries, as they can obtain oil at a lower cost, which can reduce production costs and increase the purchasing power of consumers, the matter that can stimulate economic growth, especially in industries that depend heavily on oil.

Business

Professor of economics at QU: Qatari gas industry role is pivotal in transition to cleaner energy