Qatar said it’s committed to following through on the billions of dollars in investments pledged to cash-strapped Egypt, though stopped short of giving any timing while indicating the days of handouts are over.

Qatar pledged $5bn to the North African nation in March last year, and “we are committed to that,” HE the Minister of Finance Ali bin Ahmed al-Kuwari told Bloomberg TV at the Qatar Economic Forum Wednesday.

A major food importer whose finances were tipped into crisis by Russia’s invasion of Ukraine, Egypt has agreed on a $3bn International Monetary Fund deal and is racing to secure hard currency by selling state assets that range from banks to power plants and a military-owned network of gas stations.

Gulf countries such as Qatar, Saudi Arabia and the United Arab Emirates are among the likely buyers.

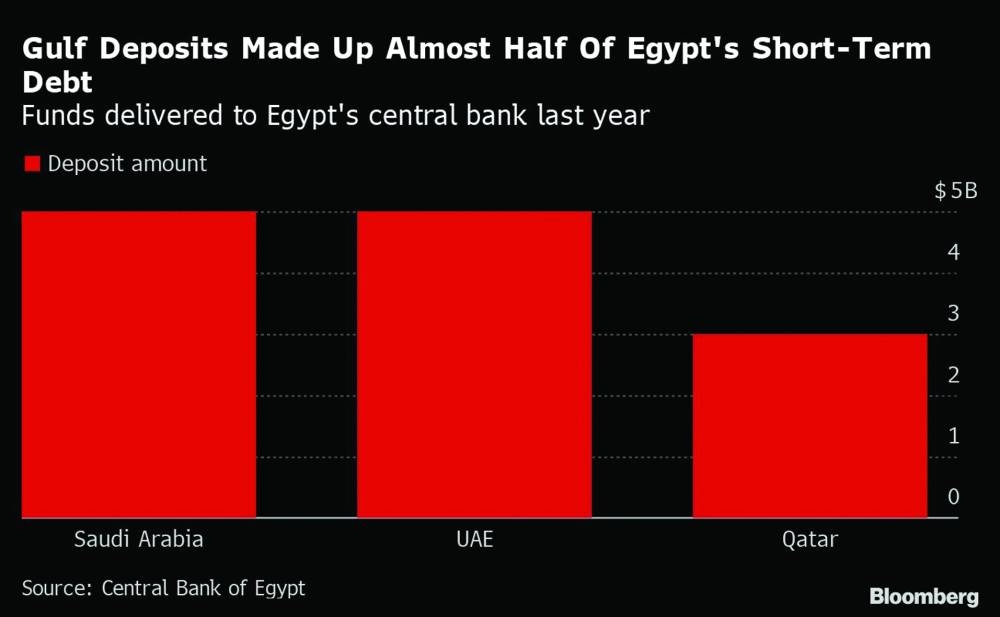

Qatar deposited $3bn in Egypt’s central bank last year to help it tackle its difficulties, but HE al-Kuwari signalled that won’t be repeated.

“With Egypt, it’s purely commercial — just giving grants and charities are no longer the case for Qatar,” the minister said. “When it comes to grants and cash and just checks, it’s becoming very difficult.”

The stance echoes that of Saudi Arabia, which earlier this year signalled it’s changing the way it offers financial help by making aid conditional on countries revamping their economies.

Egypt’s currency, which has lost about half its value since early 2022 after a series of devaluations, has been a sticking point for would-be Gulf investors who may be waiting for it to weaken further before they make deals. Embracing a truly flexible exchange rate and shrinking the state’s economic footprint are key conditions of the IMF agreement.

Qatar is open to more investments in Egypt, and looking at the manufacturing, telecommunications and tourism sectors, HE al-Kuwari said.