Al Rayan Investment, the fund manager of Al Rayan GCC Fund, announced it has paid total dividends of QR0.113 per unit to the investors of Al Rayan GCC Fund for 2022.

The dividend was paid in two tranches - QR0.063 per unit was paid in July 2022 and QR0.050 dividend per unit in January this year.

The total dividend paid for 2022 represented 5.1% of each unit held by investors. The unit value as of December 31, 2022 was QR2.219/ unit.

“We are delighted to distribute such healthy dividends in 2022, supported by very strong performance of Al Rayan GCC Fund of more than 11%. The fund assets continued to grow steadily and we thank the fund investors for their longstanding support and trust,” Haithem Katerji, chief executive officer of Al Rayan Investment said.

Net of all fees, the fund delivered total returns to investors of more than 11% in 2022. In contrast, Gulf equity markets fell more than 4% during the year.

Al Rayan GCC Fund is not only one of the largest regional Shariah-compliant GCC fund, but was also, by far the best performing in 2022.

Since inception in 2010, the fund has gained more than 140%, net of all fees, which equates to an annualised return in excess of 7%.

Al Rayan GCC Fund invests in Shariah-compliant, listed equities and sukuk in the GCC countries.

“Being one of the few asset managers in the region with expertise in both sukuk and listed equities, enables us to seize opportunities across both asset classes for the benefit of all our investors”, explained Akber Khan, senior director (Asset Management).

“The team remains committed to targeting strong and consistent returns for investors.”

Subscriptions to the fund are open to individual and institutional investors of all nationalities, living in Qatar or outside.

The minimum initial investment for an individual investor is QR35,000, with no minimum holding period.

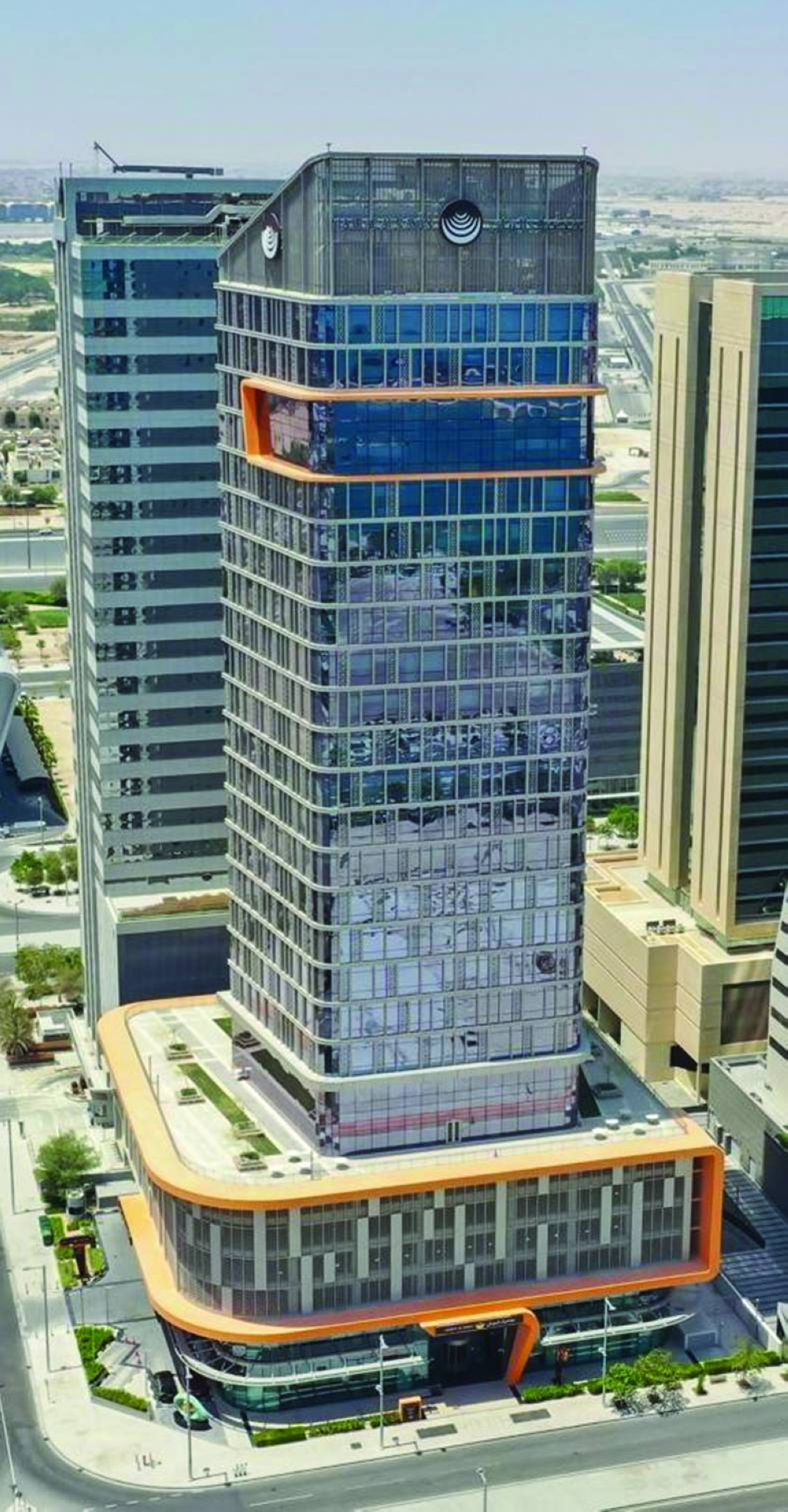

Masraf Al Rayan in its capacity as the founder of the fund, launched Al Rayan GCC Fund in May 2010. At the time, Masraf Al Rayan appointed Doha-based, Al Rayan Investment as the fund manager.

Masraf Al Rayan in its capacity as the founder of the fund, launched Al Rayan GCC Fund in May 2010.