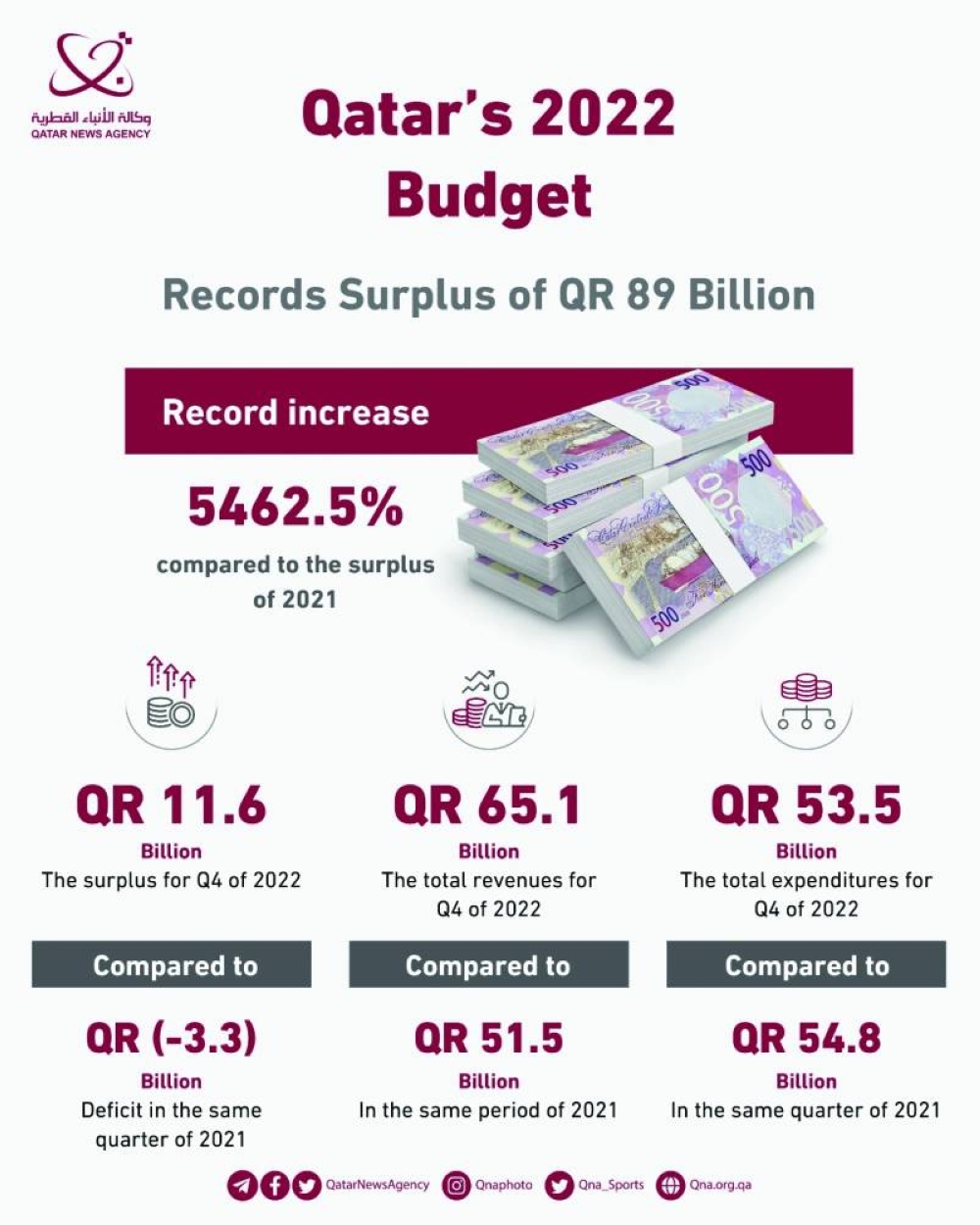

The ministry said that the surplus for Q4 of 2022 (October to December) was QR 11.6bn, compared to a deficit of QR 3.3bn in the same quarter of 2021. Total revenues for the quarter came in at QR 65.1bn, compared to QR 51.5bn in the same period of last year. Oil and gas revenues were QR 59.3bn, compared to QR 44.7bn in the corresponding period of 2021.

Total expenditures for the quarter came at QR 53.5bn, compared to QR 54.8 bn in Q4 of 2021. Wages were QR 15.4bn, compared to QR 15bn in the same period of last year. Current expenditures were QR 19.3bn for the quarter, compared to QR 16.1bn in the same quarter of the previous year. Minor capital expenditure were QR 1.4bn, compared to QR 1.1bn in Q4 of 2021.

Expenditures tied to major projects were QR 17.4bn in 2022, compared to QR 22.6bn in the same period of 2021.

Estimates when the 2022 budget was first approved were of a deficit of QR 8.3bn. HE Minister of Finance Ali bin Ahmed al-Kuwari said at the time that they were a result of the expenses related to hosting the World Cup, including security and all events accompanying the FIFA World Cup Qatar 2022.

Last year's large surplus brings to mind similar high levels achieved in 2012 (QR 77bn), 2013 (QR 106.3 bn), and 2014 (QR 108.6 bn), mainly due to the control over expenditures and the rise in revenues as oil prices recovered.

Surplus could boost Qatari Stocks: analyst

Financial analyst Tamer Hassan said that the Ministry of Finance's announcement of a budget surplus of QR 89bn in 2022 will have a positive impact on the stock market, expressing his hope that investors respond to the strong performance of the Qatari economy, as shown by various macroeconomic indicators.Hassan told Qatar News Agency (QNA) that the increase in the budget surplus was mainly driven by the increase in oil and gas surplus, saying that these levels of surpluses weren't seen since 2012, 2013, and 2014.

The financial analyst pointed out that the banking and financial services sector achieved operating returns during the past year of about QR 25bn, without considering the results of the newly listed Dukhan Bank, which will also boost Qatar Stock Exchange. He said that the banking sector's profits grew 8% last year, driven by QNB.

The financial analyst highlighted that profits for the listed companies grew compared 2021, even though they were below investors' expectations. Hassan also pointed out that dividends have also increased, but are below bond yields, which is a trend in global equity markets following interest rate hikes by various major central banks, led by the US Federal Reserve.

He said he expects the market would regain momentum in the coming period, when companies start reporting Q1 results. (QNA)