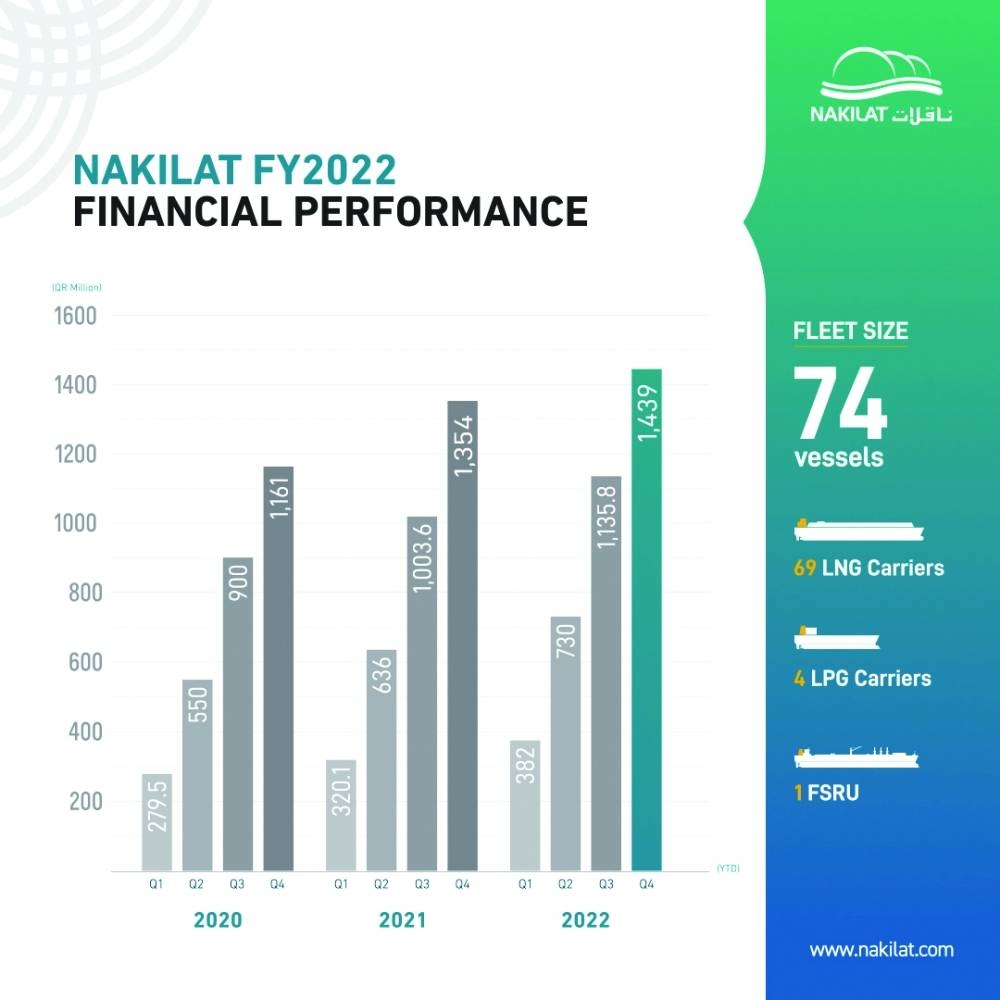

Nakilat and its subsidiaries have reported a consolidated net profit of QR1.44bn in the fiscal year 2022, registering an increase of 6.3% on an annualised basis.

The board has recommend cash dividends of 13% or QR0.13 per share, which will have to be ratified by the shareholders at the annual general assembly meeting, which has been scheduled for March 13, 2023.

The company has achieved revenues of QR4.4bn, representing a 6.3% year-on-year increase in the review period.

“2022 has been a year marked with changes and challenges that have reshaped our industry. It has also been a year exemplified by the exceptional financial performance of our company – a direct reflection of our expansion strategy, outstanding record and operational excellence in energy transportation and maritime services," said Abdulaziz Jassim al-Muftah, chairman of Nakilat.

The company’s resilience and the convergent efforts of its employees have enabled Nakilat’s sustained growth momentum and business continuity, creating immense value for both its customers and shareholders, he added.

The achievements are a strong testimony to Nakilat’s commitment to maintaining its market leadership in the energy transportation sector and at the same time, strengthening Qatar’s position as one of the largest exporters of clean energy in the world, the company said.

In 2022, the world witnessed an increased demand for clean energy, which enabled Nakilat to continue diversifying its portfolio and international presence through its fleet, flexible logistics network and its leadership position in the market, according to the company.

This was possible through the association of long-term contracts with its customers. Nakilat’s business model has ensured its resilience and ability to adapt to market fluctuations, allowing the company to generate sustainable long-term returns for shareholders, it said.

Abdullah al-Sulaiti, chief executive officer of Nakilat, said despite all the challenges the world faced in 2022 by an unprecedented pace of rise in interest and inflation rates, Nakilat managed to overcome these fluctuations with the least impact on its financial performance, a clear indication of the strength and durability of the operational excellence in the field of energy transportation and marine services.

“Through the recent strategic expansion of the company’s fleet with an additional four liquefied natural gas carriers, and the improved performance of its joint ventures operating in the dry dock, demonstrated our commitment to innovative sustainability and operational excellence. The addition to our fleet has allowed Nakilat to increase its fleet capacity and increase operational efficiency, giving us a competitive advantage at a time when the company is expanding its portfolio in the global transportation market by constantly searching for growth opportunities that benefit its shareholders in the long term,” he said.