A soft landing in global growth is still on the table due to important elements of macro strength, QNB has said in an economic commentary.

“There is no doubt that the overall current global macro environment is challenging. 2022 was a particularly arduous year for market participants as the hard realities of subdued activity; high inflation and geopolitical polarisation became more apparent. This led to gloomier economic expectations and negative movements in asset prices,” QNB said.

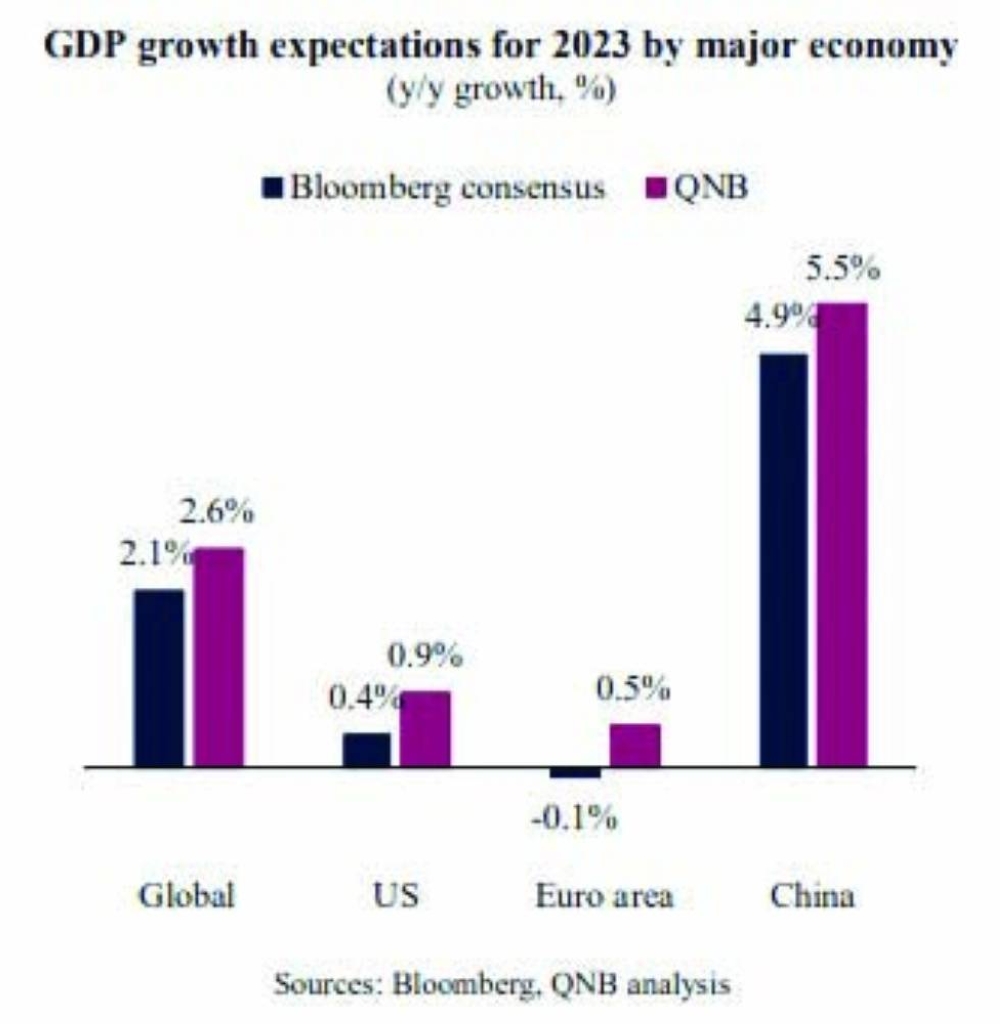

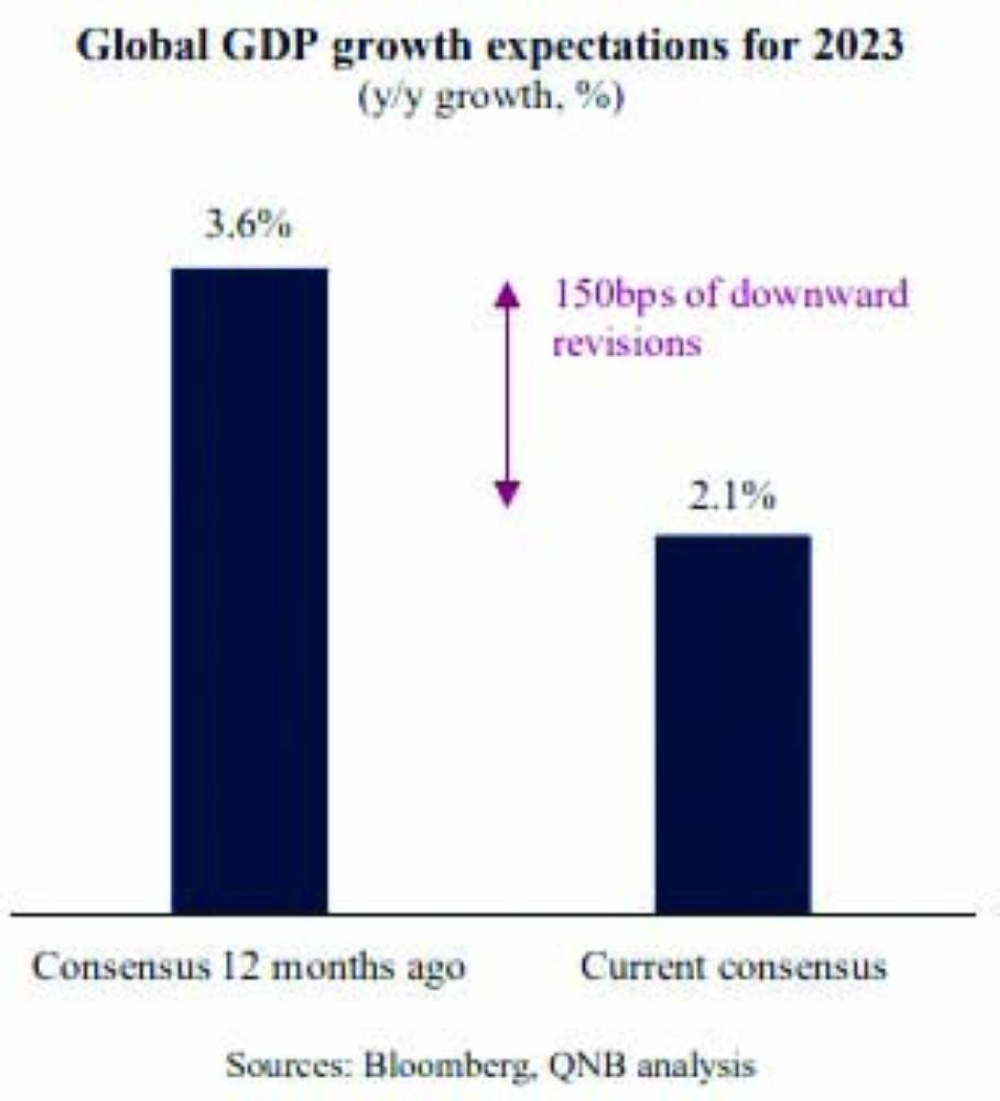

Moving forward, most analysts and investors continue to be downbeat about the macro picture. After several downward revisions, Bloomberg consensus forecasts point to a tepid global economic expansion of 2.1% in 2023, significantly below the long-term average of 3.4%.

This implies that the global economy could be effectively labelled as “recessionary,” if we use the International Monetary Fund’s threshold of 2.5% to define a global recession.

“However, as we enter the New Year in 2023, it is safe to say that a large amount of negative events is already digested and understood. In our view, the previous series of downward revisions led to overdone pessimism about lower growth prospects. We therefore expect to see the global economy growing by 2.6% in 2023, with all major economies expanding at a faster pace than most analysts predict,” QNB noted.

The Bloomberg consensus is a tool that tracks global forecasts from analysts, think tanks and research houses, presenting a range of projections as well as the median point of market expectations.

Three main factors underpin our slightly more upbeat take on the global economy for 2023, covering the US, the Euro area and China.

First, while growth in the US, the largest economy globally, is set to weaken further to 0.9% in 2023, from 1.5% last year, the performance is still going to be stronger than most analysts expect. Despite continued monetary policy tightening, which should take the Federal Reserve (Fed) policy rate to 5.25-5.5% in Q1 this year, the US economy is expected to maintain its resilience.

Consumption in the US, which constitutes around 70% of the country’s GDP, is particularly healthy, with households presenting high levels of savings available ($15.8tn). This should continue to support healthy levels of household expenditures in services, robust labour markets and consequently ongoing private sector investments, placing a floor on overall GDP growth.

Second, when it comes to the Euro area, while the slowdown should accelerate further and turn into a region-wide recession in the first half of 2023, the downturn should be more shallow than previously anticipated. At the time of writing, the energy crisis has proven to be less severe than expected on the back of a so far milder winter than expected, more effective energy saving mechanisms and high gas inventories from last summer.

Fiscal policies are likely to remain loose to support higher subsidies and direct transfers to vulnerable industries, households and regions. Moreover, the European Central Bank (ECB) will have to continue with its two-pronged policy of tightening rates to fight inflation while reallocating quantitative tools to provide a backstop to highly indebted Euro area sovereigns, particularly in the southern part of the continent.

A recovery is likely to start in the second half of the year, but may be capped by continued energy shortfalls that may emerge stronger next winter.

Third, after a year of subdued activity, China should re-emerge as a global growth engine. The Chinese economy presented poor performance in recent quarters due to an early withdrawal of stimulus policies, zero-Covid policies, a clampdown in real estate activities, tighter regulation for several industries and further geopolitical polarisation with the US.

However, China is in the midst of five major pivots, including more supportive fiscal and monetary policies, a gradual exit from zero-Covid policies, support to the struggling real estate sector, more regulatory clarity across industries and a re-approachment with the US.

Taken together, these five pivots should re-ignite activity in the country, leading to QNB’s above consensus expectation of 5.5% GDP growth in 2023.

“All in all, the global macro environment continues to be challenging. However, overly pessimistic expectations seem to be missing important elements of macro strength, such as a robust private sector in the US, a more resilient Euro area and a re-ignition of Chinese growth. We therefore believe that a soft landing on a global level is still on the table,” QNB added.