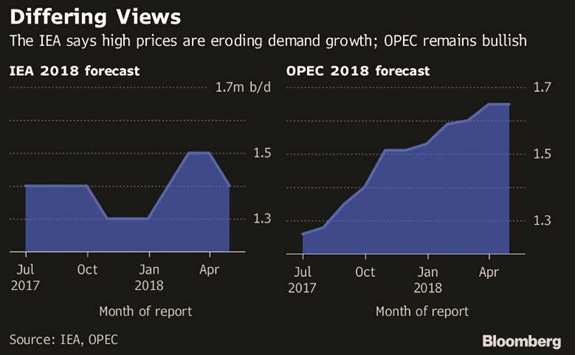

The International Energy Agency cut forecasts for global oil demand growth in 2018 as the highest prices in three years put a brake on consumption.

“The recent jump in oil prices will take its toll,” said the Paris-based agency, which advises most major economies on energy policy. Crude has climbed 17% this year, trading near $78 a barrel in London yesterday.

Opec and its allies have finally succeeded in their 16-month campaign to clear a global oil glut, with inventories falling below their five-year average for the first time since 2014, the agency said. Markets are set to tighten further as output sinks in Venezuela and the US re-imposes sanctions on Iran. Yet the resulting price rally, while giving financial relief to producers, appears to be backfiring.

Besides lowering its demand outlook, stronger prices also prompted the IEA to increase estimates for supply from Opec’s rivals, particularly the US Production outside the Organization of Petroleum Exporting Countries will grow by 1.87mn bpd this year, or 85,000 a day more than previously thought.

The agency trimmed its 2018 world demand growth projection by 40,000 bpd to 1.4mn a day, projecting total consumption at 99.2mn bpd. Although the global economy remains robust, oil prices have surged about 75% since last June, and “it would be extraordinary if such a large jump did not affect demand growth,” the IEA said. The “effect of higher prices should in particular become apparent in gasoline demand in the next few months,” it said.

Developing nations are especially sensitive to crude’s rally after many of them phased out fuel subsidies when prices were lower, the agency added.

The biggest unknown for the oil market now is the impact of US sanctions on Iran, which are being reimposed after President Donald Trump abandoned an international nuclear accord with the country, the world’s fifth-largest oil exporter.

While it’s “too soon to say what will happen this time,” the agency said, Iran’s fellow Opec members could fill the gap because their pact to restrain supply leaves them with spare production capacity.

Opec’s Gulf producers and Russia have about 1.3mn bpd of output idle, more than the 1.2mn bpd of Iranian exports that were lost when sanctions were previously imposed in 2012, according to the report.

.