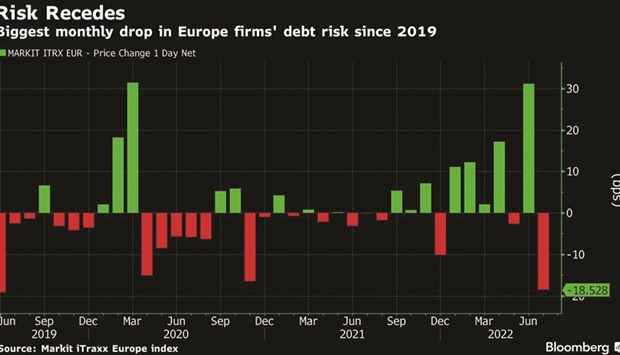

A gauge of default risk for Europe’s firms has dropped at the fastest monthly pace in three years as inflation and rate risks start to ebb.

An index of credit default-swaps on the region’s high-grade companies tightened more than 18 basis points in July, the biggest net monthly drop since June 2019, according to Markit’s iTraxx Europe index. A similar gauge for junk-rated firms declined the most since November 2020 as credit markets rebound from heavy first-half losses.

European corporate credit has been rallying since mid-July, boosted by bigger-than-expected interest rate hikes, as central banks show markets they’re serious about getting a grip on spiralling inflation.

At the same time, a euro currency slump that put it on parity with the dollar for the first time in more than two decades made European corporate debt too cheap to ignore following months of losses. Furthermore, investors reduced their short-positions ahead of the continent’s summer holiday lull, when liquidity is lower, according to Andrew Menzies, the global head of debt capital markets origination at Societe Generale SA.

“The market was strongly bid in the past couple of weeks, but that’s mostly because investors don’t like being short credit going into summer,” Menzies said. “Confidence will be fragile in the coming quarters. The outlook is difficult to predict.”

Even including the rally, default-swaps insuring the debt of the region’s best-rated firms have still ballooned nearly 112% this year. Many risks are still circling the market, including whether Russia will cut gas flows to the region, Italy’s upcoming elections and the threat of a euro-area recession.

“Italy is a risk, but when it comes to the crossread for the September primary funding window for non-financial corporates, it has much less impact than a gas rationing scenario,” said Marco Stoeckle, head of corporate research at Commerzbank AG. “Gas is flowing again, for now, but we don’t know for how long, or what will happen in the autumn.”

For now, the drop in debt risk could prove a fillip for corporate bond issuance, which tumbled in July and has struggled to gain momentum this year after firms piled in to the market during the peak of the coronavirus pandemic.

“We believe a more active-than-usual August is likely if sentiment holds up,” Commerzbank AG strategists wrote in a note to clients this morning. The market’s stop-start nature so far this year “renders periods of stable sentiment all the more valuable, and could result in very busy primary markets if they occur during such windows.”

It’s a sentiment shared by one of the region’s biggest asset managers, Janus Henderson Investors.

“If the supply window is open in September, we could be surprised by the amount of European issuance,” said James Briggs, corporate credit portfolio manager at Janus Henderson. “The pipeline isn’t massive, but there are lots of treasury desks that wish they refinanced earlier in the year.”

There are no deals being offered in the region’s primary market this morning, with market participants predicting another quiet week.

More than 350 firms have shelved over $250bn in financing plans so far this year, according to Bloomberg analysis.

The deals include initial public offerings, bonds, loans and acquisitions amounting to more than $254bn.

A two-part deal from the European Union helped the SSA sector lead July’s modest €38bn ($39bn) of marketwide issuance.

Europe’s largest exchange-traded credit funds are changing hands at a record pace. Aggregated traded value on the euro investment-grade and high-yield funds run by BlackRock’s iShares amounts to €62.7bns ($64.2bn), the most by this stage of any year, based on data compiled by Bloomberg.

Two China-based firms are braving a slow primary market with possible dollar debt deals even as financial and economic data out of their home country suggest a sluggish outlook.

Mianyang Investment is seeking to price three-year dollar notes, and Suzhou City Construction has hired banks for a possible US currency bond sale.

Singapore aims to raise at least S$1.5bn ($1.1bn) via the sale of an inaugural green bond, according to officials. Part of a sovereign and public sector issuance program worth as much as S$35bn, the debt will be launched via a book-building process within the week, the Monetary Authority of Singapore said in a statement yesterday.

Lenders Barclays Plc and UBS Group AG are both marketing dollar notes on Monday.

Puerto Rico’s Electric Power Authority and its creditors will again have more time to negotiate a deal to slash $9bn of debt as the judge overseeing the utility’s bankruptcy extended the deadline by two weeks.

Global green bonds just posted their first month of positive returns in a year, outperforming broader debt in a move that’s likely to spur pent-up investor appetite for the asset class.

graph