The Bank of Japan is buckling up for more stimulus action, QNB said and noted in a potential world of low growth and deflation, BoJ may be mirror to future of modern central banking.

BoJ continues to be at the forefront of radical monetary policy experimentation, QNB said in its weekly economic commentary yesterday.

In the aftermath of the Nikkei crash and the burst of the Nipponic asset price bubble of the late 1980s, the BoJ became a breeding ground for monetary policy innovation. In order to tackle a long-lasting debt deflation spiral (1987-2013), BoJ officials were the first to launch unconventional monetary measures such as zero or sub-zero policy rates and quantitative easing (QE) or large scale purchase of domestic securities. These policies were only incorporated in the toolkit of other major central banks after the global financial crisis of 2008-09, QNB noted.

In 2012, Japanese Prime Minister Shinzo Abe launched a bold economic plan to support more robust real and nominal GDP growth. Commonly known as ‘Abenomics’, the plan also aimed to push domestic prices up.

Hence, ‘Abenomics’ required ever more aggressive actions from the BoJ. In this context, the BoJ pledged to double the monetary base with extensive quantitative measures.

In order to fulfil its ‘Abenomics’ mandate, the BoJ has directed an unprecedented acceleration of its asset purchases of equity exchange traded funds (ETFs).

While other central banks have purchased corporate debt, no other central bank has moved this far up the risk spectrum in terms of its asset purchases. Moreover, the BoJ adopted what it terms “yield curve control” or “YCC” in the summer of 2016. Under YCC, the BoJ now targets the 10-year government bond (JGBs) yield and shorter-dated government papers, ie, it acts to set or “fix” the yields or prices of government bonds with maturities of 10-years or lower, QNB said.

As a result of previous bouts of monetary stimulus, the BoJs balance sheet ballooned from JPY 160tn ($1.7tn) in January 2013 to JPY619tn ($5.8tn) in March 2020. This makes the BoJ by far the most inflated central bank of all major economies, with its total assets comfortably exceeding the country’s GDP.

The BoJ now owns about 43% of Japan’s outstanding government securities and holds the equivalent of 6% of the total market capitalisation of the Tokyo Stock Exchange.

And there is more on the way of monetary stimulus for Japan as the BoJ has recently responded to the massive coronavirus (Covid-19) shock. Over the past few weeks, the BoJ launched additional measures to support Japan’s economy and avoid another deflationary wave.

QNB analysis has delved into the four main take aways of recent BoJ actions, placing them within the context of the overall Japanese monetary policy framework.

First, the BoJ left policy rates unchanged and decided against eventually taking them further into negative territory from the current level of -10 basis points (bps). The decision is consistent with the idea that once policy rates get to the effective lower bound around zero, additional cuts may have increasingly negative side effects, such as adverse impacts on domestic bank earnings and poor investment performance of life insurers and pension funds.

In a society with demographic headwinds as the population gets older, low returns on investments may dampen consumer sentiment, weakening overall demand.

Second, the annual purchase limit for JGBs, previously at JPY80tn ($747bn), was removed, signalling that upward pressure on yields due to additional fiscal expansion will not be tolerated. In other words, it reassures the YCC policy irrespectively of the magnitude of government spending/public financing needs.

Third, the BoJ announced a more active stance on equity ETF purchases by temporarily doubling the annual upper limit of additional outstanding positions to JPY12tn ($112bn).

A support to domestic equity markets is key for the country to avoid a further deterioration of financial conditions. Fourth, when it comes to corporate financing support, the BoJ increased the upper limit on additional purchase of commercial paper and corporate bonds from JPY1tn ($9bn) to JPY7.5tn ($70bn) for each asset class. The purchasing criteria was also eased, broadening the scope of potential assets for purchase. This supports the corporate debt market by providing liquidity and narrowing risk spreads, which also contributes to ease financial conditions.

“All in all, we believe that the BoJ is ahead of the curve and will likely put all the stops to support the economy should additional stimulus be needed. In that case, given the limited monetary policy space as per conventional tools (interest rates), the BoJ will have to size up on the use of unorthodox measures.

“This is expected to provide important information for other key central banks as they slowly follow the path of the BoJ in the use of ever expanding quantitative measures. In a potential world of low growth and deflation, the BoJ may well be a mirror to the future of modern central banking,” QNB noted.

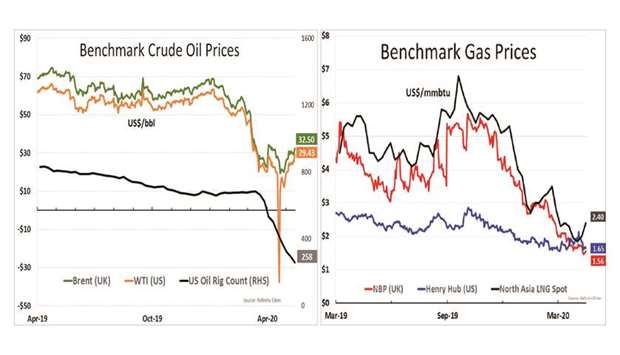

graph