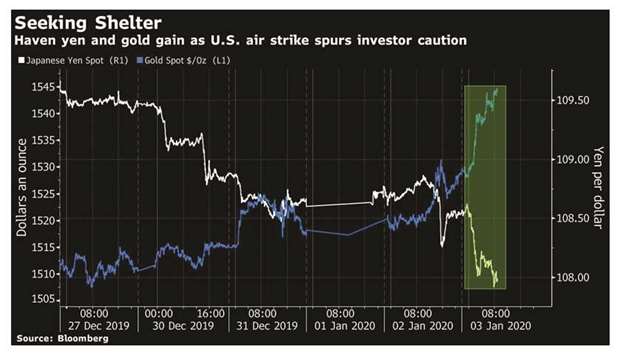

The tone in global financial markets has turned cautious after a US airstrike killed a top Iranian commander, fuelling concern over an escalation in tensions.

US stock futures dropped and Asian shares reversed gains, while oil spiked along with the yen and gold. Qassem Soleimani was killed at the direction of US President Donald Trump. The risk-off move deepened after Iran’s supreme leader, Ayatollah Ali Khamenei, said “severe retaliation” awaited Soleimani’s killers.

Vinay Pande of UBS Global Wealth Management, examines market reaction to escalating tensions with Iran.

The shock news comes after most asset classes had a stellar 2019, with US equities capping one of the best years of the past decade.

Here are 10 analysts and money managers on what it means for the market outlook:

BlackRock: Wei Li, head of iShares EMEA investment strategy in London.

“Within the space of 24 hours, sentiment took a 180-degree turn. This very much characterises the sort of year we expect 2020 to be: On the one hand, fundamentals are getting a bit better, trade headlines are getting a bit better, but on the other hand, bouts of volatility will be frequent.

“Given how strong sentiment is and how fundamentals have been in terms of bottoming out and to some degree recovering, we could see investors using this opportunity to potentially buy the dip. Until we actually see tangible evidence of uncertainty impacting growth, we could see investors being quite tactical around the event.”

Fidelity Investments: Jurrien Timmer, director of global macro in Boston.

“If I can find an issue with the market, the forward P/E is now at 18 1/2. It essentially front-ran an expected improvement in earnings, and now those earnings have to come through, which I think they will.

But at an 18 1/2 forward P/E, there’s not a lot of margin for error, and so when you add something geopolitical like this, it’s not the same as being at a 15 P/E. And so that leaves the market a little bit vulnerable, at least over the near-term.”

Societe Generale: Kit Juckes, chief FX strategist in London.

“Gold’s a winner as tension increases, and oil prices are higher too. Bond yields are lower, the equity rally which was underway in the US has stalled but not gone dramatically in reverse, and in the FX market, safe havens and oil-sensitive currencies benefit but it’s the yen which is the clear winner.

“The key level to watch is probably EUR/JPY 120. That probably holds unless there is further escalation.

“Given the scope for tension to persist in the Strait of Hormuz, a protracted period of higher oil prices has to be a risk.”

Credit Agricole: Valentin Marinov, head of G10 currency research in London, who calls the timing of the escalation “unfortunate.”

It could “dash market hopes for a rebound of the global economy that is still to emerge from under the cloud of the US-China trade war. Risk sentiment should remain fragile also because central banks may be slow to respond or simply no longer have the arsenal to respond in an adequate way.” He calls the yen and Swiss franc “attractive,” while saying the conflict could weigh on “risk-correlated oil importing currencies like the Korean won.”

ING Group: Antoine Bouvet, senior rates strategist in London.

“Recent episodes of US/Iran tensions have not resulted in material escalation but even in a fairly benign outcome to this crisis, the bid in US Treasuries and bunds should last at least into next week.”

Colombo Wealth: Alberto Tocchio, chief investment officer in Lugano, Switzerland.

“The ‘severe retaliation’ aspect is possibly what is scaring the markets as it could mean that there will be a counter-attack versus American diplomats. Markets could use this excuse to take some profits as sentiment and positioning are possibly too high.

“We would then use the possible weakness to increase our equity exposure.”

Saxo Capital Markets: Kay Van-Petersen, global macro strategist in Singapore.

“We are moving potentially from proxy versus proxy to potentially direct Iran-backed forces versus US forces.” However, “net-net, I struggle to see what Iran can really do.

“People are still not back at their desks fully until next week to mid-January, so illiquidity could give us some overreaction to the downside. Still, let’s see how the next 24 to 48 hours play out. Remember, it’s the weekend already in the Middle East.”

The gain in oil “honestly feels a touch overdone.” But this is positive for US defence spending and even French defence stocks could get a boost later, he noted. “So much for Trump calling troops home.”

Covenant Capital: Edward Lim, money manager in Singapore.

“This attack merely highlights the geopolitical risk of the oil markets, and the market undergoing a possible oil shortage in the first one to two quarters of 2020.

“We didn’t do anything on the news as we have already bought some oil stocks such as CNOOC and Total when oil was trading close to $60s at the end of 2019.”

UOB Kay Hian (Hong Kong): Steven Leung, executive director in Hong Kong.

“Investors are worried that the situation in Iran will worsen, since there could be some retaliation after the US attack. People will want to cut risk ahead of the weekend. Stocks have rallied a lot in the past month or so, so any bad news flow is a reason to take profit.”

Mizuho Bank: Ken Cheung, chief Asian FX strategist in Hong Kong.

“The reversal of risk-on sentiment will keep Asian FX under pressure. The US Dollar Index also appeared to find a footing.

These factors will probably prompt profit-taking flow on EM Asian FX. The magnitude could be amplified by thin liquidity during the New Year holiday.”

.