Reports on Friday that the United States and China were close to completing some parts of a trade deal boosted sentiment yesterday, before Wednesday’s US Federal Reserve rate decision.

The trade war is a key factor in the Fed’s rate outlook.

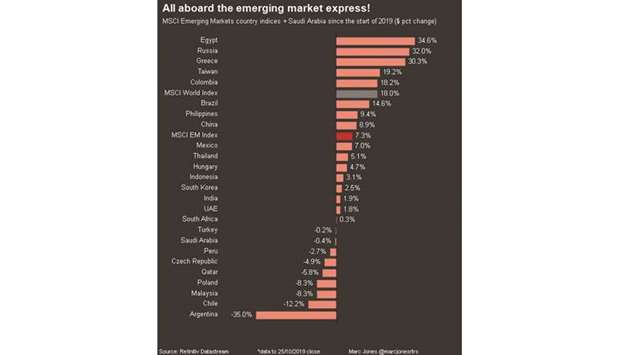

MSCI’s emerging-market equities index gained 0.5%, while Chinese stocks rose 0.9%, fuelled by hopes of tangible progress being made on the US-China trade front.

The yuan recorded its best close in domestic onshore trade since August 19, as MSCI’s developing-world currencies benchmark rose 0.2%.

“The Federal Reserve’s monetary policy currently is a function of US-China trade tensions and how detrimental that is going to be to the US economic slowdown...the trade headlines are going to dictate everything,” said Simon Harvey, FX market analyst at Monex Europe.

“(US Fed Chair Jerome) Powell previously said you can’t model monetary policy given the US-China trade tensions.

The market has fully priced in a rate cut, so all eyes will be on the forward guidance.”

Russian stocks gained 0.4%, with Surgutneftegas rising about 1%. Shares of the pipeline operator have risen about a third in the week through yesterday.

Turkey’s lira rose 0.8% and Turkish stocks slipped dipped 0.1% in shortened trading hours before a local holiday on Tuesday. South Africa’s rand was up 0.5% after reaching a month-and-a-half high earlier in the session.

The country’s medium term budget a Moody’s review of South Africa’s credit rating are due this week.

Monex Europe’s Harvey said foreign investors were beginning to hold South African bonds again, noting their relatively attractive yield and falling costs for credit default swaps.