Kenyan President Uhuru Kenyatta has demanded that lawmakers remove a cap on commercial lending rates, refusing to approve the 2019/20 (July-June) budget unless the limit is lifted, a document sent to parliament from the presidency showed yesterday.

The move was the latest in a running dispute over the rates cap, which the government and banking officials say is debilitating to the economy because it stalls lending.

In 2016, the government limited rates banks can charge customers to four percentage points above the central bank’s benchmark – currently 9% – saying they were concerned about high rates.

Last month, lawmakers rejected a June request by the Treasury to remove the cap, saying lenders had not proven they could be trusted to lower rates without pressure.

The move was the second attempt by the government to repeal the cap after a similar try last year was blocked by lawmakers.

“The capping of interest rates has not addressed the intended objective particularly in expanding credit access,” Kenyatta said in the note to parliament.

Kenyan bank shares surged on the Nairobi bourse after the news.

The cap has cut private sector credit growth as commercial banks cut off millions of low-income customers deemed too risky to lend to, government officials and bank executives say.

It has also had a knock-on effect on the real economy as credit-starved businesses lay off workers and real estate developers find it hard to sell homes to a credit-short market.

“Investors will react positively to this news, in light of the harmful effects of the loan rate cap on Kenya’s growth prospects, and the unnecessary complication that it creates for policy,” said Razia Khan, head of research for Africa at Standard Chartered in London.

The central bank, which found in a study last year that the cap had probably cut 0.4% from 2017’s economic growth, has complained that the cap has also made it hard it to transmit its monetary policy signals.

It takes an average of three-five months longer for policy decisions to be transmitted under the capping regime compared with a free interest rate regime, Kenyatta said, citing research by the central bank.

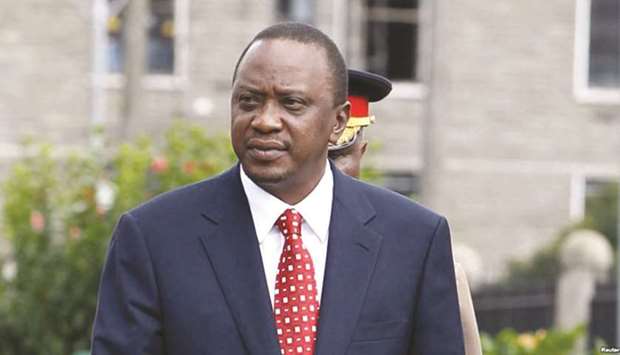

Kenyatta: dispute with lawmakers