Emerging market stocks rose for the sixth straight session yesterday buoyed by lingering trade optimism, while the Turkish lira held steady ahead of a top-level meeting between Turkey and the United States regarding Syria.

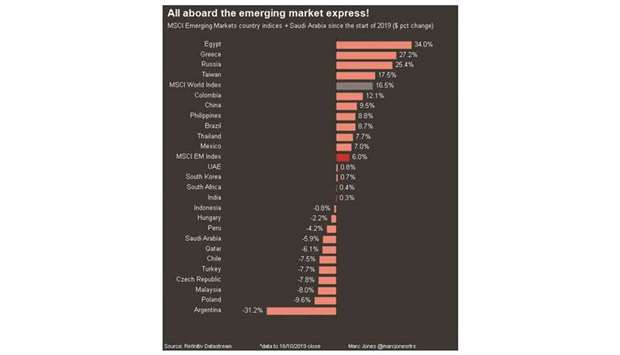

MSCI’s index of emerging market stocks rose 0.3%, in its longest winning streak since an 11-day run in April.

Mainland China shares ended flat, while most others in Asia rose, along with those in Turkey and Russia.

MSCI’s currency benchmark also firmed as the dollar hovered near one month lows after weak retail sales data dimmed outlook for the US economy and raised bets for an interest rate cut.

On the trade front, Washington said US and Chinese trade negotiators are working on nailing down a Phase 1 trade deal text for their presidents to sign next month, and were open to more meetings if necessary.

“These are borderline markets; running out of left-over half-full glass type of optimism,” Vishnu Varathan, head of economics and strategy for Mizuho Bank, Singapore, said in a note.

The Turkish lira, which has lost around 4% this month knocked by US sanctions and threats of more against the country’s offensive into northeastern Syria, was little changed.

Turkey’s President Tayyip Erdogan is due to meet with US Vice President Mike Pence and Secretary of State Mike Pompeo later in the day.

The meeting is aimed at convincing Erdogan to declare a ceasefire in Syria, which the Turkish leader stated will “never” happen.

US President Donald Trump warned of ‘devastating’ sanctions if the discussions fail.

Turkey said it’s preparing retaliatory sanctions against the already placed sanctions.

South Africa’s rand snapped a three-day losing run to rise 0.6%. It had lost up to 1% last session, following nationwide blackouts by state utility Eskom again after nearly seven months.

The power outage continued for a second day yesterday.

Broader sentiment remained subdued as investors remained tense ahead of a two-day European Union summit that will focus on last-gasp efforts to seal a deal on Britain’s exit from the bloc.

Central and eastern European currencies traded marginally higher against a steady euro.