Tech leaders in Asia are warning that risks from ongoing trade tensions are broadening, accelerating the fragmentation of the global industry and threatening collaboration in key research areas.

China and the US announced face-to-face negotiations will be held in the coming weeks, but the prospects for a quick resolution to the trade conflict look slim. Some tech companies are seeing weakening sales and their competitive edge erode, pushing players to radically overhaul supply chains. Such splintering may now extend to other areas, including critical fields like artificial intelligence, in which the pair of global superpowers lead.

“The risk of the tension of the nature we see between the US and China – the two largest economies – is that we may end up with a global economy that’s fragmented and supply chains that are fractured,” said Singapore’s Communications and Information Minister S Iswaran. “That supply chain and fragmentation pertains to markets, investment flows and cooperation in terms of technology as well.”

The minister was speaking at Bloomberg’s Sooner Than You Think technology conference in Singapore yesterday, an event that featured representatives from US tech giants including Microsoft Corp, International Business Machines Corp as well as Chinese artificial intelligence pioneer SenseTime Group Ltd.

Ongoing trade tensions have been particularly hard on the tech players in both the US and China. Tariffs have made it more difficult to win business, eroding the competitiveness of American companies in China. US tariffs on roughly $110bn worth of consumer imports from China went into effect at the beginning of this month, drawing retaliation from Beijing.

The trade war “makes it very difficult for us to do business in China,” said Kevin Lyman, chief executive officer of Enlitic Inc, a medical AI company. He said the company works with hospitals, insurance brokers and other local organizations to deliver its services but trade tensions had made it harder to continue working with some of these partners in China.

In May, Washington added Huawei Technologies Co to an entity list that curbed the Chinese tech giant’s ability to sell equipment in the US and prohibited it from purchasing components from American suppliers. This move is also a blow to American suppliers, who are seeing their market share dip as they miss out on sales opportunities in China.

“I think the US-China issues are more than the trade war issues. Fundamentally they are issues of technology. I think 5G and IOT (internet of things) is important because, not just from an economic standpoint but from the military complex, dominance in those technologies is a game changer, so I think that’s a source of tension,” Piyush Gupta, CEO of DBS Group Holdings Ltd, told Bloomberg TV.

The harsher business environment is also pushing tech companies on both sides to re-evaluate their operations, giving rise to a splintering of supply chains - into one that serves customers inside China, and another one outside of China that’s serves American customers.

US President Donald Trump has even taken to Twitter to order multinational companies out of China.

“We continue to push for free trade,” said Harriet Green, CEO of IBM Asia Pacific, adding that her business depends on the movement of technology and people. Open global trade is also important in developing the future of AI, cloud and blockchain technologies, she said.

Many American companies that have spent decades wading deeper into the world’s most populous country in search of new markets, now face the prospect of losing hard-won market share in China to rivals from Europe, Asia - as well as from Chinese companies whose increasing sophistication means that in some cases they now offer viable alternatives to foreign tech products.

As a result of the trade war, many Chinese tech firms are developing their own alternatives to certain American technologies like semiconductors, said Xu Li, CEO of Chinese AI leader Sensetime. For the past two years, his company has been developing its own tailored chips for applications like healthcare and autonomous driving to rival more general-purpose chips from American companies like Nvidia Corp.

Still, Sensetime aims to create a platform for idea exchange and collaboration internationally because that’s where “technology breakthroughs” come from. The company is focusing on partnerships with academic institutions that bridge “East and West,” he said.

The disconnect is particularly acute in emerging technologies, where a tussle for leadership in areas like artificial intelligence and advanced computing underpins US-China trade tensions. The backlash has prompted concerns over the technological setbacks that could result from a pullback in global collaboration, and has led to calls for more cooperation, not less. “No country has the resources and technologies it needs” to tackle the coming technology wave, said Tom Mitchell of the school of computer science at Carnegie Mellon University, at the World AI Conference in Shanghai last week. “We must have global cooperation in AI.”

“I don’t think anyone wins a trade war in the end,” said David Kenny, CEO of ratings and consumer tracking company Nielsen Holdings Plc, which operates in more than a hundred countries. “The uncertainty does cause investment levels to come down.”

He said AI models improve with more global data and without the ability to share data across borders makes all the algorithms less effective. “Those who share globally are going to beat any individual countries’ initiatives,” he said.

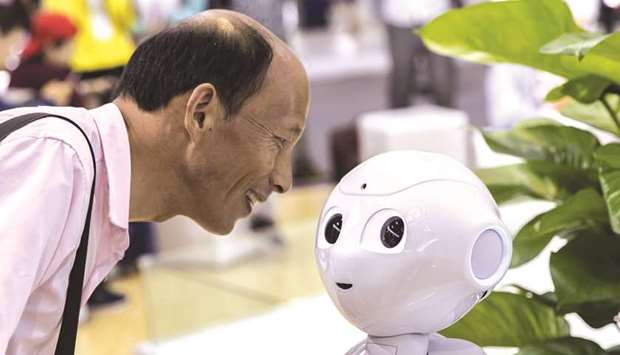

An attendee looks at a CloudMinds Technology Cloud Pepper semi-humanoid robot at the World Artificial Intelligence Conference (WAIC) in Shanghai on August 29. Tech leaders in Asia are warning that risks from ongoing trade tensions are broadening, accelerating the fragmentation of the global industry and threatening collaboration in key research areas.