The TV industry has an unlikely new star: Leon Black.

The billionaire investor is poised to become one of the biggest players in local television thanks to a deal-making spree. His private equity firm, Apollo Global Management LLC, is working on a trifecta of transactions that could give it control of more than 40 stations from Atlanta to Seattle.

First off, Apollo is in talks to buy a group of local television stations from Nexstar Media Group Inc for more than $1bn, according to people with knowledge of the matter. The deal could be announced in the next week, said the people, who asked to not be identified because the discussions aren’t public.

That transaction is designed to help set the stage for another big TV prize: a batch of stations worth about $3bn that Cox Enterprises Inc is selling. Apollo is negotiating a deal for those channels and plans to combine them with the Nexstar assets — along with a dozen stations that the private equity firm agreed to buy last year from little-known Northwest Broadcasting Inc, the people said.

Clinching the Nexstar stations gives Apollo the scale it needs to be able to offer the Cox family an equity stake in the combined business, helping them win that auction, according to the people. The plan is to house the Cox, Nexstar and Northwest assets under the same parent entity, but run the Cox stations separately, they said.

Reuters first reported that Apollo was nearing a $3bn deal for the Cox stations and that the firm would merge them with the Nexstar assets, if it wins them.

Together, the assets are priced at more than $4.2bn, the people said. If it succeeds, Apollo would reach almost a quarter of US households with its TV stations, based on Bloomberg Intelligence estimates.

A representative for Irving, Texas-based Nexstar declined to comment. Representatives for New York-based Apollo and Cox in Atlanta didn’t immediately respond to requests for comment. A broader deal frenzy is underway in the regional broadcasting industry as the US Federal Communications Commission considers loosening restrictions on how many television stations one company can own. The current rule prevents any one broadcaster from owning stations that reach more than 39% of the nation’s households.

Sinclair Broadcast Group Inc was long the biggest company in local TV — and the most acquisitive. But Nexstar’s $4.1bn deal to buy Tribune Media Co in December is poised to vault it into the No 1 spot.

While owning more TV stations helps companies such as Sinclair and Nexstar operate more efficiently and save money, it also puts them at risk for running afoul of ownership rules as they grow. That’s why private equity buyers like Apollo have an edge: They can close deals more quickly, giving sellers greater certainty in an auction.

Apollo has been eager to exploit this advantage.

The firm, famous for buyouts of companies such as ADT Inc and Hostess Brands Inc, was beaten in the December auction for Tribune by Nexstar — despite teaming up with Northwest for the stations. Now that Nexstar has to sell some Tribune stations to win regulatory approval, Apollo has another shot to pick up TV assets.

Nexstar chief executive officer Perry Sook said he received expressions of interest from four potential buyers within a couple of hours of announcing the Tribune deal on December 3. Apollo was one of them, people familiar with the situation said.

Nexstar is divesting stations in more than 10 markets where there’s overlap with Tribune, including Hagerstown, Maryland; Portland, Oregon; and Indianapolis. They generate earnings before interest, taxes, depreciation and amortisation of about $150mn, according to the people.

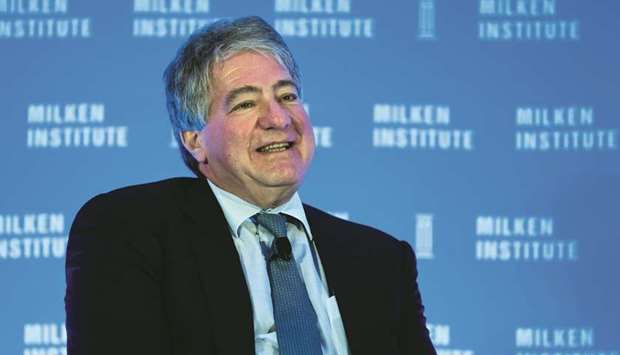

Leon Black, chairman and CEO of Apollo Global Management, speaks at a summit in Singapore (file). Black’s private equity firm, Apollo Global Management, is working on a trifecta of transactions that could give it control of more than 40 stations from Atlanta to Seattle.