GDP growth in South-East Asia remained robust in the second quarter of the year despite headwinds from slower world trade and tightening monetary policy, QNB has said in an economic commentary.

Inevitably, there are important differences among the region’s key economies but the resilience of consumer spending is a common thread, auguring well for the bloc’s future prospects, it said.

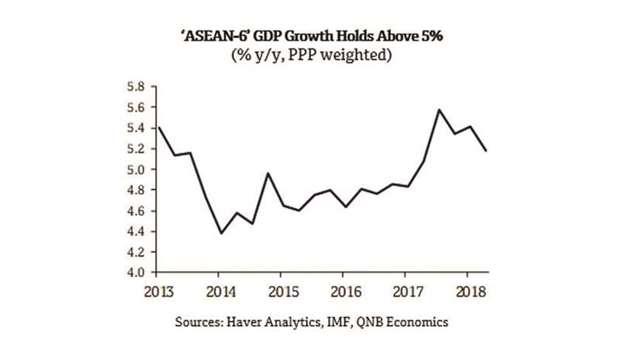

The pace of economic growth in Indonesia, the Philippines, Singapore, Thailand, Malaysia and Vietnam – who QNB has referred in aggregate as the ‘Asean-6’ – cooled off in the second quarter (Q2) but remained robust.

QNB’s weighted aggregate eased to 5.2% year-on-year (y-o-y) but nonetheless held above 5% for the fifth successive quarter.

Indonesia, the regional superpower by dint of its 250+ million population, saw its GDP growth improve to 5.3% y-o-y; up 0.2% from Q1.

Consumption in particular was strong (5.2% y-o-y) and remains the backbone of the Indonesian economy. Fiscal policy helped support consumption thanks to a big jump in civil service bonuses. Increased government subsidies to oil companies also helped by limiting increases in fuel prices.

Government support for consumption is welcome given Bank Indonesia’s pro-active approach to monetary policy this year. The central bank has already lifted its policy rate by a cumulative 125bp as it seeks to limit the depreciation pressure facing the Indonesian rupiah as the US Federal Reserve’s steady drip-feed of interest-rate increases continues.

With at least one further 25bp rate hike by Bank Indonesia likely before year-end and next year’s Presidential election also looming, a populist tilt to Indonesia’s recently released draft Budget is therefore unsurprising.

The budget, which proposes big increases in cash handouts, via further pay hikes for civil servants, a doubling of benefits for poor households and further increases in fuel subsidies, will provide a further fillip to consumer demand if passed by Congress and help keep Indonesia’s overall GDP growth ticking over around 5%.

One concern is that increased cash handouts will blunt Indonesia’s infrastructure spending drive. After impressive average growth of 30% per annum since 2014, the 2019 draft budget pencils in only a modest 2.4% increase for infrastructure spending next year. Given the high import content of infrastructure spending, the budgeted slowdown would at least work to curb Indonesia’s goods trade deficit next year and further reduce the pressure on the rupiah.

The Philippines’ infrastructure spending boom meanwhile remains very much in full swing thanks to President Duterte’s ambitious ‘build, build, build’ development plan. Its impact dominated the Philippines Q2 GDP data. While household consumption, supported by solid remittance inflows, enjoyed healthy growth of 5.6% y-o-y, fixed asset investment surged by an eye-popping 21.1% y-o-y!

“The aforementioned high import content of investment spending helped power a 19.7% y-o-y gain in imports which, in turn, saw net trade slice 0.5% off y-o-y GDP growth. Despite this drag from imports, overall GDP growth was still a robust 6% y-o-y in Q2,” QNB said. With the Philippines capex boom set to continue, the drag from trade on GDP growth may build further. Despite booming domestic demand, GDP growth may therefore dip below the 6% mark in the next few quarters.

Further deterioration in the Philippines goods trade deficit and its corollary, pressure on the Philippines peso, should also continue. Like Bank Indonesia (BI), the Philippines central bank – Bangko Sentral ng Pilipinas (BSP) – has been steadily tightening monetary policy this year; lifting its key policy rate by 100bp. As with BI, further rate hikes from BSP look likely in the balance of the year.

Elsewhere in Asean, Singapore logged slower, but solid, GDP growth of 3.9% in Q2 as the impact of slowing world trade was felt. By contrast, Thailand’s economic recovery continued with GDP growth up a robust 4.6% y-o-y in Q2. Continuing the regional theme, Thai consumer spending was buoyant. Up 4.5% y-o-y, it posted its fastest growth since 2013.

With a mammoth current account surplus of around 10% of GDP, the Thai Baht has been better insulated than the Indonesian rupiah or Philippine peso against USD strength so far this year. In turn, this has helped Bank of Thailand to so far stand pat on monetary policy in contrast to much of the rest of the region, QNB said. Malaysia’s Q2’s performance was perhaps the one partial disappointment across the region. GDP growth pulled back to a six-quarter low of 4.5% y-o-y. Slowing export growth and sluggish government spending and investment growth were the culprits.

By contrast, private consumption registered stellar growth of 8% y-o-y; its fastest growth since Q1, 2015. While this breakneck pace will be hard to sustain, the recently elected government’s repeal of the Goods and Sales Tax (GST) will work to support consumer demand in the coming quarters.

Last, but by no means least, Vietnam remains Asean’s star performer, QNB noted. GDP growth did cool a little to 6.9% y-o-y versus Q1’s 7.4% y-o-y, but this still leaves Vietnam as one of the world’s fastest growing emerging markets.

Vietnam’s low wages but highly skilled labour force continues to suck in foreign direct investment into the job-rich electronics and textiles sectors, powering an export boom. Strong growth in tourism is further boosting exports.

Quarterly national accounts data on household consumption is not available but retail sales growth of 10.5% y-o-y y in Q2 attests to the strength of Vietnamese consumer demand, further extending the regional theme of consumer strength.

With its strong population growth and vibrant consumer demand, Asean will remain a key focus for QNB.

gra