Malaysian businesses remained the largest issuer of corporate sukuk in 2017, data from the Security Commission Malaysia shows.

Malaysia accounted for 60.6% share in global volume of new corporate sukuk issuances, amounting to a total of 87.65bn ringgit ($21.6bn) as per the end of last year, up from 64.82bn ringgit ($15.9bn) in 2016 and 57.57bn ringgit ($14.2bn) in 2015. The considerable increase in issuances last year reflects issuers’ banking on a more positive economic outlook which is expected to prevail in 2018. From January to May, as per available data from the Securities Commission’s homepage, corporate sukuk issuance in Malaysia stood already at 39.03bn ringgit ($9.6bn).

Corporate sukuk denominated in the local currency increased by a whopping 50% last year, spurred by increases in both the rated and unrated segments. The structures of Malaysian issuances were more diverse than other jurisdictions and showed a range of Shariah-compliant contract types such as murabahah, mudarabah, musharakah, ijarah and wakalah. There were also hybrid structures that combined more than one type of contract. Maturities of the sukuk also varied between short-, medium- and long-term, while the economic sectors represented a broad range, including energy and utilities, retail, telecommunication, real estate, infrastructure, financial services, transportation, industrial conglomerates, education, agriculture, oil and gas, as well as property and construction. As a first for the country, there were also two issuances of green sukuk to fund a solar power project and the construction of three large solar photovoltaic plants, respectively.

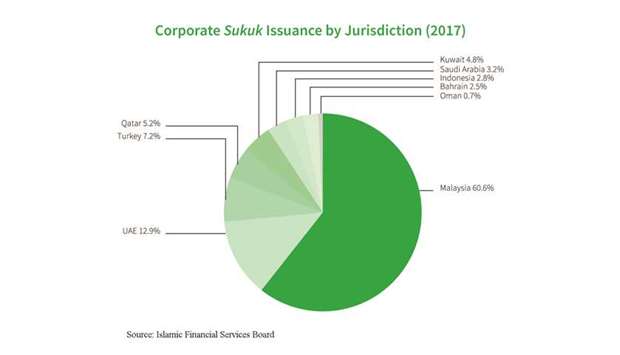

Malaysia was followed in the 2017 corporate sukuk issuer rating by the United Arab Emirates (UAE), Turkey, Qatar and Kuwait with a market share in new issuance of 12.9%, 7.2%, 5.2% and 4.8%, respectively, according to data found in the Islamic Financial Service Stability Report 2018 compiled by the Islamic Financial Services Board of Malaysia’s central bank Bank Negara.

Saudi Arabia, despite remaining the largest issuer of sovereign sukuk, interestingly dropped from rank three to sixth on the global ranking last year due to reluctance of businesses to take on more debt at a time of political changes and a transformation of the country’s domestic economy.

In the UAE, where last year all corporate sukuk were issued in US dollars, corporate issuers spread from banks to real estate-related companies, including Dubai Islamic Bank, real estate developer Damac and Emirates Reit, a Shariah-compliant real estate investment trust. Overall corporate sukuk issuances in the country were down by 27.5%, reflecting a general unease of investors across the Gulf Co-operation Council (GCC) countries and regional Corps’ continuation to operate with relatively limited investment programmes, according to debt watcher Standard & Poor’s. Regional and international political developments also increased investors’ risk perception of the GCC over the past twelve months as a result of planned or executed introduction of value-added tax regimes, energy subsidy reforms and other public revenue-enhancing initiatives which have created “pressure and uncertainty,” the rating agency said.

Turkey showed strong corporate sukuk issuance activity last year, with most Islamic bonds issued in the local currency and all structured under an ijarah concept, with ?ukuk transactions being conducted via asset leasing companies.

Qatar saw a year-on-year decline in corporate issuances of 20.4% since 2015, the data shows. All corporate issuances from Qatar in 2017 were by Qatar Islamic Bank across a range of currencies, including US dollar, Australian dollar and yen with maturities ranging between two and five years.

suk