Yesterday, the central bank made a record injection of longer-term funding available to commercial lenders, after publishing looser-than-expected rules governing the $15tn asset management industry on Friday.

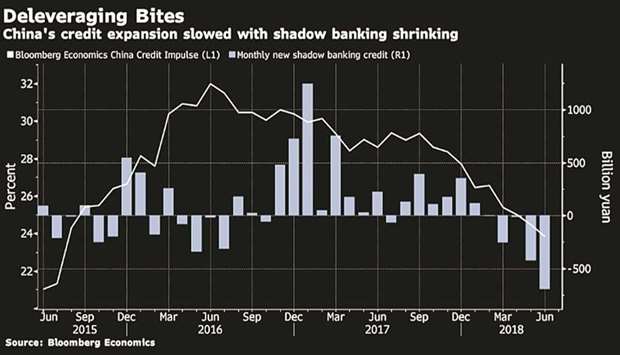

Against the backdrop of worsening trade relations with the US and the growth-damping effects of a multi-year campaign to curb debt, both initiatives add to signs that the central bank is adopting a more supportive stance, even though it hasn’t announced any official shift from its “prudent and neutral” policy.

Growth in the world’s second-largest economy is forecast to slow this year to 6.5%, in line with the official target.

“China’s economy is now more sensitive to any uncertainties in the financial system,” said Lu Ting, chief China economist at Nomura International Ltd in Hong Kong. “Policymakers are adjusting the pace, scope and scale of the deleveraging drive.”

The PBoC offered 502bn yuan ($74bn) of Medium- Term Lending Facility credit with one-year maturity to major banks in the open market yesterday.

That’s the most in such an operation since the MLF was introduced in 2014.

In recent months the PBoC has focused on adding liquidity in a targeted fashion, with the aim of alleviating funding pressures on the private sector, where companies have traditionally faced higher hurdles to obtaining credit.

Reserve requirements have been cut three times this year.

The central bank’s move towards monetary easing from the current neutral stance is more evident in the size of yesterday’s liquidity injection, and follows reports last week that the central bank asked lenders to invest in lower-graded corporate bonds in exchange for such funds, said Ming Ming, head of fixed-income research at Citic Securities Co in Beijing.

Ming said the PBoC wants to offset the impact from previously tight credit, and he predicts the PBoC will cut reserve-requirement ratios one or two more times this year, with the next one coming in the third quarter.

A major headwind facing the economy on the back of tighter credit would be the ensuing slump in private-sector investment, which has been a key pillar of the economy this year.

Private companies have found it difficult to borrow anywhere, with shadow banking credit contracting, bond defaults rising to a record pace, smaller lenders downgraded and dollar debt repayment pressure mounting.

The banking and insurance regulator last week asked financial institutions to “earnestly implement” plans to help reduce financing costs for smaller firms.

On Friday, regulators took a softer stance than expected as they tightened rules on the asset management industry, underscoring the balancing act between deleveraging the financial system and slowing an economy already facing challenges.

China’s shadow-banking sector saw the biggest net monthly drop on record in June, according to Bloomberg calculations based on the central bank’s data, weighing on the supply of new credit to the real economy.

While a formal change of direction on the anti-leverage campaign or an official shift to monetary easing could potentially come at meetings of the top political leadership, from the end of this month, officials are unlikely to abandon goals to cut debt or cut borrowing costs more broadly. China is still at the “initial phase” of monetary easing, and there’s room for the reserve requirement ratio to be cut further, to about 8% to 10%, said Nie Wen, an economist at Huabao Trust Co in Shanghai.

“The PBoC hopes to soothe the tight credit situation as soon as possible while not hindering the debt curbing progress too much, but it’ll have to cut reserve ratios if the large injection of MLF loans doesn’t achieve the desired effects,” he said.

The money multiplier, the ratio between broad money supply and the central bank’s base money, which gauges the pace at which banks are lending, fell back to 5.56 in June after rising to the highest level of 5.72 in the previous month on easing policy tweaks.

The shift indicates banks remain reluctant to turn money offered by the central bank into loans to the real economy. Liquidity conditions aren’t the constraint for credit expansion, and only “decisive and coordinated” policy adjustments on monetary, fiscal, and regulatory fronts can help neutralise the monetary conditions, Eva Yi, analyst at China International Capital Corp wrote in a report.