The latest consensus forecasts clearly show global growth topping out. The average of 2018 global growth, having climbed steadily from 3.3% last September to a peak of 3.8% in June, has now edged back down to 3.7%. The 2019 consensus is also turning down, slipping to 3.6% after reaching 3.7% in early June, QNB said.

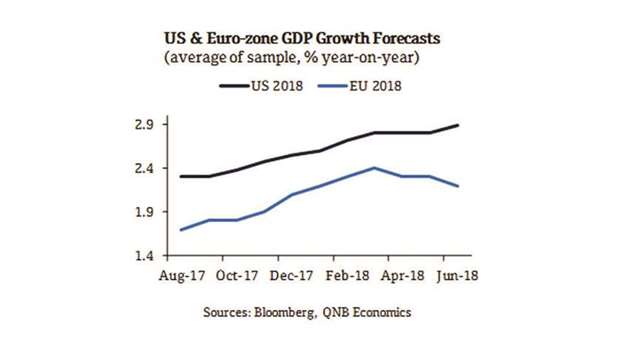

Importantly, global growth is now cooling off even as the US economy shows signs of further acceleration. Consensus forecasts for US GDP growth for 2018 have actually pushed higher over the last month, ticking up 10bp to 2.9%. Estimates for 2019 US growth are also holding steady, continuing to average a robust 2.5%.

With the US not the culprit, slowing global growth reflects downward data surprises elsewhere. The Eurozone, Japan, and emerging markets are the key offenders, according to QNB.

“The consensus forecast for 2018 eurozone growth for example has now dropped back from 2.4% in April to 2.2%. 2019 estimates have also ticked down to 1.9% from a recent peak of 2%. Japan has seen an even more decisive momentum shift with the consensus for 2018 GDP growth dropping to 1.1% from 1.4% in April.

“The recent slowdown in the eurozone and Japan is a concern given policy settings at the central banks in both economies remains super accommodative. With growth already slowing, the ability of both central banks to eventually tighten policy is increasingly being questioned,” QNB said.

Less synchronised global growth has been the key driver of the US dollar’s renaissance in recent months. The buoyancy of US growth has entrenched expectations of the US Federal Reserve’s drip feed of interest rates hikes continuing even as prospects for tighter monetary policy in Europe and Japan have dimmed as their economies have slowed.

The stronger US dollar has fuelled the other key driver of slowing global growth: weaker emerging markets. A stronger USD works as monetary tightening for much of the world economy, spurring capital inflows into US assets, and forcing many emerging markets to tighten monetary policy to help limit capital outflows and stabilise currencies.

With the USD’s broad trade-weighted index gaining around 5% since the end of March, it is no surprise that emerging market growth prospects are souring, QNB said. The consensus for GDP growth in overall emerging markets in 2018 has slipped from 5% to 4.9% over the last month. Estimates for 2019 are also starting to dip, also edging down 10bp to 5%.

“Emerging market growth forecasts are slipping despite GDP forecasts for the biggest emerging market, China holding steady for now at 6.5% for 2018 and 6.3% for 2019. But, as highlighted in last week’s commentary, recent Chinese data show clear signs of domestic demand cooling off,” QNB said.

In contrast to most other emerging markets, China is now loosening policy settings. Given the inevitable lags between policy actions and their impact on the real economy, China’s recent easing measures may not gain traction for several months.

Looking ahead, there are three key reasons to expect that momentum shift under way in the global economy will continue.

First, the US Federal Reserve looks set to press on with its slow, but steady, policy tightening until booming US growth of around 3% throttles back to its longer-run sustainable rate of around 2%. At close to full capacity and set to grow around 1pp above its long-run trend this year, US growth can realistically only travel in one direction.

Second, with monetary policy settings in the eurozone and Japan to all intents and purposes still flat out, the central banks in these two critical economies have little, or no, ammunition to combat any further slowdown.

Their only real weapon is to further delay their provision plans to begin normalising policy settings in 2019. But, by further widening expected policy divergence with the US, this would tend to exacerbate recent US dollar strength, adding to pressures on emerging markets.

Third, and perhaps most importantly, is the escalating risk of a global trade war led by the US and China. While the tit-for-tat tariffs so far imposed affect only a small portion of both economies, each further escalation reduces the chances of compromise and so increases the risk of a full-blown trade war.

And with China quickly running out of US imports on which to impose retaliatory tariffs, further rounds of tariff increases by the US may force China to fight back with non-tariff measures. Of these, a large competitive devaluation of its currency, the CNY, is perhaps the greatest danger. By further amplifying US dollar strength, CNY weakness would further tighten global monetary conditions, quickly drawing the rest of the world into the cross-fire of the US-China trade conflict.

“In conclusion, a cocktail of steady Fed tightening, limited policy ammunition in Europe and Japan and the mounting threat of global trade war risks further cuts to global growth forecasts.

“The world’s two biggest economies, the US and China, have so far propped up global growth forecasts but the downside risks to both economies are now climbing as US interest rates steadily climb with the two countries seemingly on collision course over trade,” QNB said.