Global credit rating agency Moody’s has upgraded the outlook of Doha Bank to “stable” and affirmed the long-term issuer default ratings (IDR) at ‘Aa3’.

The upgrade to stable, follows the revision of the Qatari sovereign’s outlook to stable and affirmation of the country’s long-term issuer and foreign-currency senior unsecured debt ratings at ‘Aa3’, and reflects Moody’s view that Qatar can withstand the economic, financial and diplomatic boycott by the three neighbouring Gulf Co-operation Council countries.

Doha Bank group chief executive Dr R Seetharaman said Moody’s ratings recognised resilience of the Qatari banks and Qatar’s operating environment to the economic blockade and the support of Qatari Government for banking system in Qatar.

“The government has demonstrated a strong commitment to its banks and key public sector companies, which has been reaffirmed during this crisis. Qatar had shown buoyancy in the times of crisis and this upgrade was testament of its fundamental strength,” he said.

In response to the economic blockade Qatar has emerged strong and has brought various reforms to transform itself into a self-reliant economy. Some of these reforms include landmark residency bill, relaxing entry visa requirements for citizens of 80 countries and enhancing food security, he said.

Qatar will also raise liquefied natural gas production by 30% to 100mtpa within five to seven years after lifting a moratorium on gas development earlier in 2017.

Moody’s rating affirmation factored in several credit strengths embedded in Qatar’s credit profile, which remains supported by the large net asset position of Qatar’s government, exceptionally high levels of per-capita income, very large hydrocarbon reserves and relatively low fiscal and external breakeven oil prices — all of which will continue to provide a significant shock absorption capacity to the sovereign.

Business / Business

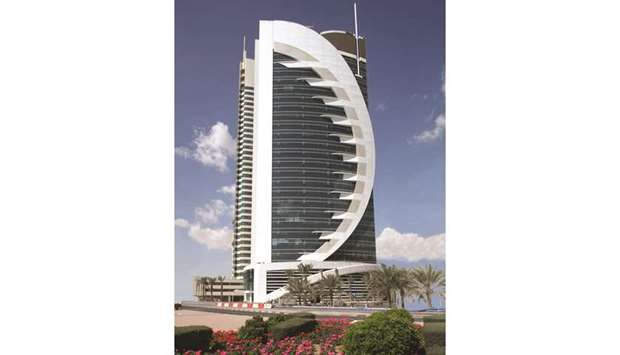

Moody’s upgraded outlook of Doha Bank reflects view that Qatar can withstand challenges, says CEO

Doha Bank’s upgraded outlook to u201cstableu201dfollows the revision of the Qatari sovereign’s outlook to stable and affirmation of the country’s long-term issuer and foreign-currency senior unsecured debt ratings at ‘Aa3’