The rise in Lebanon’s bonds doesn’t get the country off the hook. Analysts say it’s time to deliver on reforms, or else the country’s debt burden may spiral out of control.

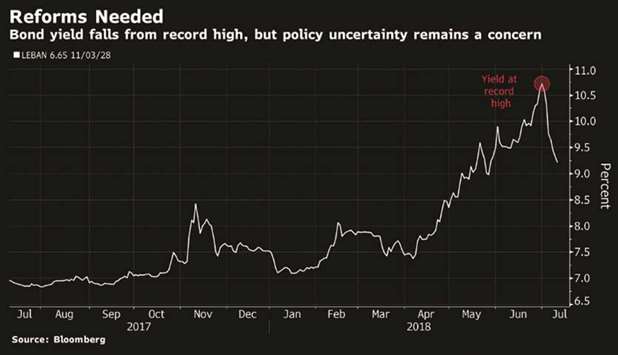

The yield on the nation’s dollar bonds due 2028 plummeted about 150 basis points from an all-time high of 10.7% at the end of June. And while the cost to insure the country’s debt against default plunged about 135 basis points over the past week, it’s still the highest in the Middle East and Africa.

Even as pressure on the bonds eases, they’re among the hardest hit in emerging markets as the roll-back of crisis-era stimulus worldwide and the spectre of a global trade war dent demand for riskier assets. That adds to investor concerns over the cost of servicing Lebanon’s debt, which is equivalent to almost half of government revenue, making it the highest of all sovereigns that Moody’s Investors Service rates.

The outlook for the bonds will depend on the government’s ability to implement much-needed reforms, particularly in fiscal policy, according to AllianceBernstein. In order to access about $11bn in grants and loans pledged by delegates from 41 nations in April, it needs to enact measures to make its economy and government more efficient. That includes cutting spending and tackling corruption. But Lebanon needs to form a cabinet “to start fiscal consolidation,” Carla Slim, an economist for Standard Chartered Plc in Dubai. Prime Minister-designate Saad Hariri has struggled to do so after the Hezbollah group emerged in a stronger position in May’s parliamentary elections.

“Policy uncertainty especially around fiscal consolidation and Hezbollah’s macro priorities remain a key concern,” said Shamaila Khan, AllianceBernstein’s director of emerging-market debt in New York. The asset manager held the country’s 8.25% bonds due in 2021 as of end-May, according to data compiled by Bloomberg.

Lebanon will likely see its debt reach 180% of gross domestic product in five years from 150% in 2017, according to the Washington-based International Monetary Fund. That’s on a par with Greece, which underwent the world’s biggest debt restructuring.

Central bank governor Riad Salameh said Lebanon’s ample foreign reserves had allowed it to keep the currency stable despite recent volatility in emerging markets, but it was imperative that the next government cut the deficit and boost the private sector.

The central bank “agrees with the views of the International Monetary Fund and ratings agencies on the need to reduce the deficit-to-GDP ratio,” Salameh told a conference in Beirut. “The markets are awaiting the formation of a government and expecting its priorities to include reform.”

While the outlook for the debt remains poor, any further declines will likely be “moderate” following the recent hammering, said Richard Segal, a senior analyst at Manulife Asset Management Ltd in London.

“At the right level, the bonds could be attractive for tactical reasons, given how cheaply the sovereign has become in general, given the strong track record of remaining current on external debt, and the healthy banking system,” Segal said. “But the debt levels are not sustainable indefinitely.”

Option-adjusted spreads on Lebanese debt blew out about 130 basis points this year, double the increase in emerging-market debt, according to Bloomberg Barclays indexes. At 609 basis points, Lebanon’s risk premium is the highest among developing nations.

“Any country with significant refinancing risks has underperformed the market this year,” said Max Wolman, a senior investment manager at Aberdeen Standard Investments in London. While the bonds could drop further given geopolitical tensions in the Middle East, the country has significant foreign-exchange reserves, which should help cushion it from additional capital outflows, he said.

Foreign reserves — currently at more than $40bn — have enabled the local currency to survive the political storms that periodically left Lebanon without a president or prime minister, as well as the influx of 1.5mn Syrian refugees. Prices are rising, however, with Salameh predicting inflation of between 4% and 5% this year, while the government has struggled to boost growth, seen at 2% in 2018.

The central bank will remain “conservative” in its policy as long as there is no progress on reducing the deficit, Salameh said. “This rise in inflation, in addition to the political risks and higher interest rates globally, has led to an increase in rates in the local market,” he said.

The central bank has maintained stability through stimulus measures and financial engineering, made possible by the billions of dollars deposited into Lebanese banks by the nation’s diaspora.

But Hariri is nowhere near forming a ministerial team amid infighting and demands by political leaders for greater representation. Lebanon’s political system dictates that the prime minister must be a Sunni, the president a Christian and the speaker a Shia, while parliament seats are divided among different religious sects.

“The country cannot afford any more political mishaps delaying policy-making and investment,” said Christopher McKee, chief executive officer of PRS Group, a New York-based global risk analysis firm. “The spread on sovereign debt and interest rates is unlikely to narrow anytime soon, particularly given tighter US monetary policy and creeping inflation.”

.