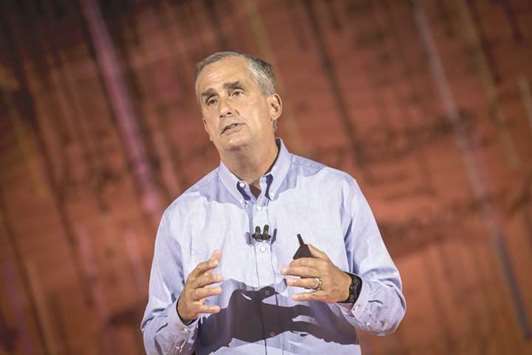

Intel Corp chief executive Brian Krzanich resigned yesterday after a probe found his consensual relationship with an employee violated company policy.

The head of the largest US chipmaker is the latest in a line of powerful men in business and politics to lose their jobs or resign over relationships viewed as inappropriate, a phenomenon highlighted by the #MeToo movement.

“An ongoing investigation by internal and external counsel has confirmed a violation of Intel’s non-fraternisation policy, which applies to all managers,” Intel said in a statement.

The board named chief financial officer Robert Swan as interim CEO and said it has begun a search for a permanent CEO, including both internal and external candidates.

Intel declined to give any further information about the probe.

Intel shares fell 1.5% in early trade.

Wall Street took Krzanich’s unexpected departure in stride.

“Although we respect Krzanich’s efforts in redirecting Intel’s strategy from a computer-centric to a data-centric company, we view Intel as a process-driven company with a deep bench of CEO candidates that can continue to drive the corporate strategy,” said Kevin Cassidy, an analyst at Stifel.

Krzanich, 58, was appointed Intel CEO in May 2013, and was in charge of moving the company’s focus to growing data centres from personal computers.

Intel shares more than doubled during his tenure.

He was recently credited with containing the fallout from the disclosure of some security flaws in the company’s chips that could allow hackers to steal data from computers, although his sale of some Intel stock before the flaws were disclosed to investors attracted some criticism.

“There are no new payments as part of his departure,” a source familiar with the company told Reuters.

Temporary replacement Swan has been Intel’s CFO since October 2016 and previously spent nine years as CFO of eBay Inc. Intel yesterday raised its second-quarter revenue and profit forecast, saying it expects quarterly revenue of about $16.9bn and adjusted profit of about 99 cents per share, up from a previous forecast of $16.3bn in revenue and adjusted earnings per share of 85 cents.

Analysts on average were expecting revenue of $16.29bn and adjusted profit of 85 cents per share.

Krzanich: In the soup.