Hedge funds are rolling forward long positions in the Brent futures contract, and in the absence of offsetting factors this is depressing the value of expiring contracts, pushing futures prices into contango.

Since the end of June 2017 hedge funds and other money managers have built up a near-record net long position in Brent in the expectation that prices will continue to rise.

Hedge funds held long futures and options positions equivalent to almost 615mn barrels on May 15, according to position reports published by the Intercontinental Exchange.

These were partially offset by short positions amounting to 66mn barrels, giving a net long of almost 549mn barrels.

Fund managers also held 374mn barrels of positions in the calendar spreads, offsetting long and short positions in different contract months.

Some positions were held in the form of options, but most were futures, with a net long position in futures alone amounting to 519mn barrels.

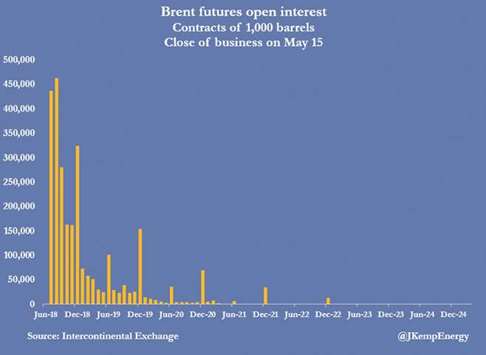

For the Brent contract as a whole, the total number of open positions in futures across all maturities and all market participants was equivalent to 2,704mn barrels.

Of all the open positions, almost 44% were concentrated in the first three contracts expiring in July 2018 (437mn barrels), August 2018 (463mn barrels) and September 2018 (281mn barrels).

Unless the hedge fund positions were distributed very differently to other market participants, a substantial number must have been held in the first three months.

In fact, many fund managers, especially those following momentum-based strategies, have a strong preference for liquidity, so they tend to hold their position in the closest and most liquid contract months. But as those contracts approach expiry, positions must be rolled forward or allowed to terminate automatically with the passage of time

The rolling forward of long positions tends to push the front end of the futures curve from backwardation towards contango because they involve the simultaneous sale of a near-term contract and purchase of one further forward.

Of course, for every long position there is a short, and the rolling of short positions tends to have the opposite effect, pushing the market from contango towards backwardation.

In theory, the impact of rolling forward long and short positions should be neutral.

In practice, different groups of market participants employ different strategies and have a different impact on price formation.

Hedge funds and other money managers tend to be dynamic price-makers rather than passive price-takers because they trade on expectations of where prices will move in future.

The sheer number of hedge fund long positions already established in the market and needing to be rolled forward each month is now weighing on prices at the front end of the curve.

While fund managers were still accumulating net longs between June 2017 and March 2018, the negative impact on near-term calendar spreads was masked by the amount of new buying each month.

But hedge funds have been reducing their net position in Brent since the middle of April.

The net position has been cut by 84mn barrels, or 13%, since April 10.

If the problem of rolled longs persists, many more hedge funds are likely to try to escape it by shifting positions further along the curve towards contracts expiring in 2019 or 2020.

* John Kemp is a Reuters market analyst. The views expressed are his own.

.