The Monetary Authority of Singapore (MAS) estimates that the exchange rate has twice the impact on the economy as interest rates as a result of the extreme openness of Singapore to trade and capital flows (trade is about 230% of GDP, compared with around 26% of GDP in the US, for example).

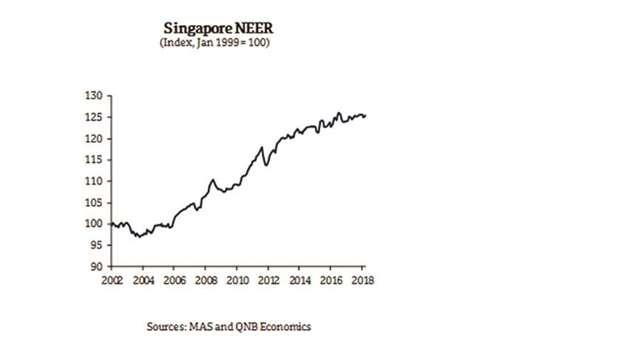

The value of the Singapore dollar is allowed to fluctuate within a band (currently estimated to be +/-2%) against an undisclosed basket of currencies – also known as the nominal effective exchange rate (NEER).

At its semi-annual monetary policy statement on April 13, the MAS decided to tighten policy by “increasing slightly” the slope of the Singapore dollar nominal effective exchange rate (SGD NEER) from the zero per cent appreciation path that has been in place since April 2016.

In its accompanying statement, the MAS noted that “the width of the policy band and the level at which it is centred will be unchanged.

This policy stance is consistent with a modest and gradual appreciation path of the SGD NEER policy band that will ensure medium-term price stability”. While the MAS does not explicitly announce the slope of the SGD NEER policy band, it is believed that it has been set at an appreciation slope of 0.5% per annum.

Since April 2004, the MAS has set an appreciation bias for the NEER as the anchor for monetary policy as the country ran large current account surpluses and continues to be a highly open economy.

There have been only two occasions since then when the MAS has moved to a flat path or zero percent appreciation anchor for the SGD NEER.

The first such occasion was in October 2008 following the global financial crisis when external and domestic demand fell sharply and inflation declined to levels incompatible with price stability.

The second occasion was April 2016 when the economy was struggling with disinflationary pressures and core inflation was projected to remain below 2% over the medium.

The move in April 2018 to “increase slightly” the slope of SGD NEER should be seen as the beginning of a gradual normalisation process in monetary policy as the economy continues to expand, resulting in a tighter labour market while inflation is projected to rise over the medium term towards 2%.

The monetary policy decision was accompanied by an Advanced Estimate of GDP which showed GDP growth rising to 4.3% y/y in 2018Q1 from 3.6% y/y for 2017 as a whole. Looking ahead, the MAS expects global demand to remain firm, although the risks to global trade have increased as trade tensions rise between the US and China.

The gradualism in the MAS approach to tighten monetary policy appears to be motivated by uncertainty surrounding trade tensions between the US and China and the fact that the Singapore economy is highly sensitive to fluctuations in global trade.

This suggests that if trade tensions between the US and China ease meaningfully over the coming months, the MAS is likely to further increase the slope of the SGD NEER at the next policy meeting in October 2018.