Qatar’s overall real GDP growth will exceed 2.8% this year from the earlier forecast of 2.5%, QNB said in an economic commentary.

QNB said it was revising up its Qatar GDP growth forecasts for three main reasons.

First, QNB recently raised its forecast for oil prices from $55 a barrel to $63 a barrel, which will lead to higher incomes and spending in the non-hydrocarbon sector.

Second, it now expects a sharper rebound in hydrocarbon output as maintenance on LNG production facilities appears to have been dragged out in 2017, but should now be completed.

Third, the economic impact of the blockade has been less than expected and QNB has, therefore, reduced the expected drag from the blockade on 2018 GDP.

As a result, QNB is now forecasting overall real GDP growth of 2.8% in 2018 from 2.5% previously.

According to QNB, Qatar’s GDP growth in the fourth quarter of 2017 was held back by the hydrocarbon sector.

(The Ministry of Development Planning and Statistics (MDPS) released its GDP data for the fourth quarter of 2017 at the end of March).

The latest data showed an unexpected drop of 6.4% in hydrocarbon production in Q4 from the previous quarter. Given that crude oil production increased by 3.2% over this period, the drop in hydrocarbon GDP must be due to gas production, most likely as a consequence of temporary shutdowns for routine maintenance on LNG facilities.

_________________________________________

QNB expects Qatar’s overall real GDP growth to exceed

2.8% this year from the earlier forecast of 2.5%

__________________________________________

Meanwhile, the non-hydrocarbon sector grew 1.6% in the fourth quarter, or 6.6% annualised, with the finance, wholesale and retail trade, construction and real estate sectors contributing the most.

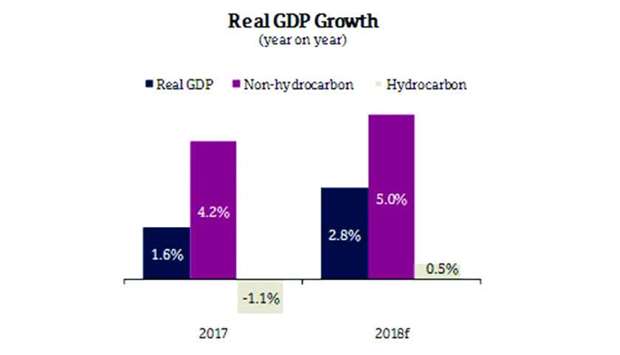

For the full year 2017, overall real GDP growth was 1.6% with the non-hydrocarbon sector growing 4.2% and the hydrocarbon sector contracting 1.1%. Lower oil and gas output in 2017 was due to both lower crude oil production and maintenance on LNG facilities.

“Looking forward, we have revised up our forecasts for growth in 2018 from 2.5% to 2.8%,” QNB said.

Higher oil prices are likely to give the authorities more comfort in relaxing fiscal constraints and raising investment, which should feed through to higher growth in the non-hydrocarbon sector.

As hydrocarbon GDP was lower than expected in the fourth quarter of 2017 due to maintenance, QNB now expects a sharper rebound in 2018 as LNG production facilities have restarted and production is normalising.

The impact of the blockade on GDP growth was less than expected in 2017, QNB noted. Notably, the blockade should have had the greatest impact in Q3, but this turned out to be the second strongest quarter in the year. Additionally, the latest data release revised up growth in the non-hydrocarbon sector for Q3 from 3.7% year on year to 4.3%.

“As we were previously expecting the impact of the blockade to be more of a drag on growth in 2018, this has led to an upward revision of our forecast,” QNB said.

To reflect these changes in the outlook, QNB has revised up its forecast for non-hydrocarbon growth in 2018 to 5% from 4.8% and for hydrocarbon growth to 0.5% from flat. This implies an overall real GDP growth rate of 2.8% in 2018, up from our previous forecast of 2.5%.

In the longer term, Qatar’s economy should benefit from a number of recent measures. Investment should be bolstered by new projects related to the expansion of LNG production and projects aimed at ensuring self-sufficiency and sustainability as well as an expected new law to allow 100% foreign ownership of new companies.

Therefore, QNB said it expects the underlying growth rate of both the hydrocarbon and non-hydrocarbon sectors to continue rising into the medium term.