Last week at the National People’s Congress (NPC), an annual policy summit for the Chinese leadership, a real GDP growth target of 6.5% in 2018 was announced. This is the same target as the previous year when the economy accelerated to 6.9%.

“But there is significantly less optimism around a similar outcome in 2018,” QNB said. The focus of the economic agenda at the NPC was on reigning in financial stability risks rather than finding ways to engineer faster growth. The authorities have ramped up efforts to curtail shadow banking, reduce leverage and tackle overcapacity, all of which are likely to result in slower growth in 2018.

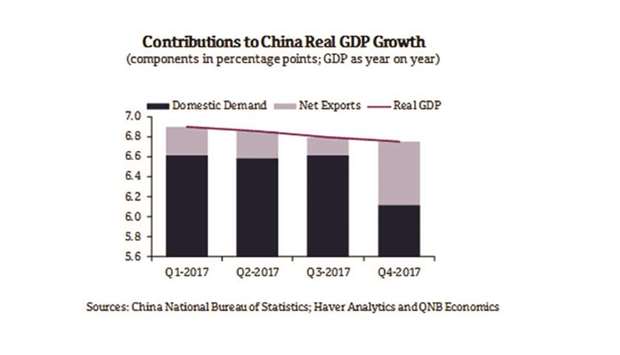

In addition, external risks such as new protectionist policies in the US could reduce external demand for China’s exports. In short, we expect growth in China to moderate from 6.9% in 2017 to 6.4% in 2018. Slower growth momentum in the Chinese economy is already materialising. Real GDP growth peaked in Q1 2017 and eased gradually each quarter over the course of the year. Growth was elevated due to robust net exports on the back of a firming global economy but this was partially offset by weakening domestic demand, particularly fixed asset investment.

Driving the weakness in domestic demand was an increase in the minimum required loan-to-value ratio pushing down property demand, pollution curbs effecting industrial activity and less credit expansion in the face of tighter domestic liquidity and higher interest rates.

“Our own activity measure of the Chinese economy, an index comprising of eighteen different macroeconomic and financial indicators corroborates a similar story,” QNB said. Activity peaked in first half of the year and tailed off in the second half as property prices and industrial production cooled. “Interestingly, our measure shows a sharper acceleration at the start of the year and a stronger decline in latter months of 2017 than do the official numbers. “We expect this downward trend to continue in 2018 for three main reasons,” QNB said. First, the effect of the curbs on the property market and large polluters, first imposed in late 2016, will continue to depress the housing market and the industrial base. Downturns in these sectors are typically long-lasting and cyclical recoveries can take over a year to emerge. China’s last property market downturn lasted two years, 2010 to 2012, and the industrial sector itself has been in decline since the financial crisis.

Second, the authorities are signalling that they will continue to reign in credit growth in 2018, which should slow overall investment in the economy.

A range of new measures have been imposed in recent months including restrictions on lending for investments in real estate, equity markets as well as on loans to local governments. Local government bond issuance has also been limited.

Furthermore, to implement and monitor compliance with regulations, the authorities have created a new super regulator by combining the banking and insurance regulators and increasing its powers.

Third, there is now uncertainty around how firm external demand will be for exports this year. The US administration is currently investigating the intellectual property implications of its trade with China and has suggested it would like to see the $375bn goods trade deficit it has with China reduced by $100bn.

Even if no formal trade barriers emerge, Chinese exporters are likely to be wary of increasing capacity and the uncertainty alone will likely result in lower investment, QNB said.

While these three factors should depress growth, they will partially be offset by solid consumption growth. The government has pledged to boost spending on pensions, healthcare and education in line with its long-term objective to rebalance the economy away from being led by investment and exports to more reliant on consumption growth.

“As a result, our forecast for Chinese growth in 2018 is 6.4%,” QNB added.