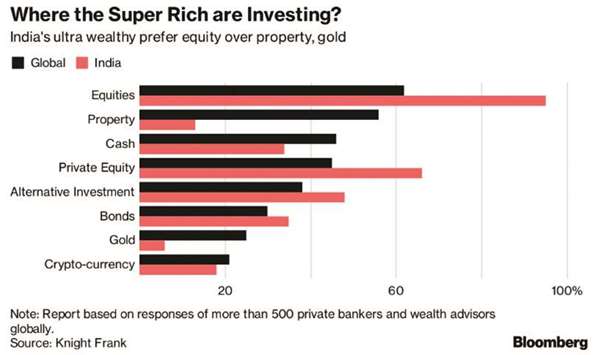

Wealthy Indians are buying stocks hand over fist, eclipsing the strong appetite for equities seen across the world, according to a Knight Frank study.

Some 95% of India’s population with net assets of $50mn or more lifted their holdings in the 12 months through October, compared with the 62% global average, the analysis showed. At the same time, they shunned historically favoured assets from property to gold, which ranked among the investments seeing the smallest allocation increase for India’s rich.

Equities have been a great choice – the global index is up 17% over the past year and India’s Sensex is 14% higher. The allure of gold and property has faded following the government’s crackdown on unaccounted wealth in 2016. Once Asia’s top real-estate market, India has witnessed a sharp drop in sales following the cash ban, new consumer protection laws and the roll-out of a nationwide sales tax.

At 17%, property investments were among the lowest contributing factor that led to an increase in wealth among Indians. That compares with 30% for Asia and 50% globally, according to Knight Frank’s annual wealth report released on Wednesday.

India’s ultra-wealthy population, defined as those with net assets of $500mn or more, grew 18% between 2016-2017, compared with an 11% rise globally. By the end of 2022 those in that super-rich category will have swelled to 340 people, a 70% jump, the report estimated.

.