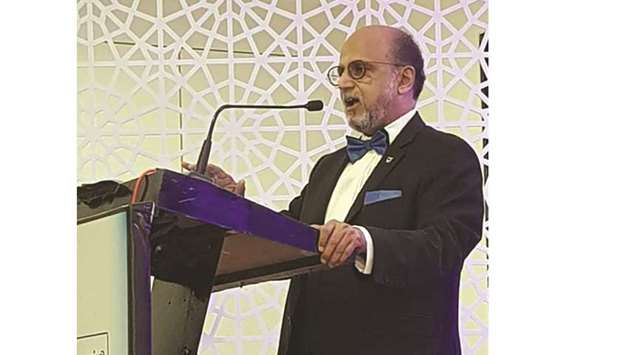

Doha Bank CEO Dr R Seetharaman said Qatar offers the right regulatory environment, “extremely competitive” operating costs, government support, funding support and a ready financial services sector to work with.

“Fintech can help achieve the Qatar Central Bank’s goals set up in the financial sector strategy. There is momentum building in Qatar, with opportunity in the areas of digital payments, money management, lending, loyalty and rewards, remittances, and investments and advisory,” Seetharaman said during the session ‘Enabling Fintech 2.0: Creating a Fintech Hub in India’.

He said an ideal fintech ecosystem features available talent, well-informed investors, and a regulatory environment. To develop such an environment, Seetharaman said banks and regulators need to collaborate with fintech firms to provide the best possible customer service.

“In India, we have more than 600 startups in the space of lending, payments, insurance, and trading space. Fintech startups are not only spearheading innovation, but are also prompt banks and financial institutions to explore new technologies and invest in digital service delivery channels.

“Qatar can explore cross border synergies with countries namely UK, Singapore, Australia, or India pertaining to the fintech sector on areas such as knowledge sharing, investments, and remittances, which could lead to collaborations and partnerships. This is vital for the development of Qatar’s fintech sector,” he stressed.

On global fintech, Seetharaman said the fintech sector is “one of the most happening sectors” across the globe.

“Fintech would continue to disrupt banks. They have also become technology providers, competing with other fintech firms and sometimes collaborating or acquiring them to roll out shared platforms to enable services.

“A number of banks are examining the methods employed by tech leaders to imitate their prowess at innovation, flexibility, and speed to market. After the explosive growth of digital payments in 2017, fintech companies are gearing up to ride on block chain and expand their portfolio of app-based services ranging from consumer lending to insurance products to cross-border remittances,” he said.