Emerging market (EM) watchers have been carefully following the recent inflation developments in the US. Higher than expected inflation could mean faster monetary tightening, which some fear would bring more investors back to the US in search of higher returns and significantly dent flows to EMs, it said.

However, QNB does not view the risk of higher US interest rates as a major threat to EM capital flows in 2018. So long as growth in EMs rises faster than in the US, which is broadly expected, that should continue to attract global investors to EMs and result in net capital inflows strengthening in 2018.

Historically there have been two main drivers of EM capital flows (excluding China): interest rates and economic growth. Higher interest rates and growth in EMs, relative to advanced economies, tend to attract capital as they offer higher returns to investors. “Higher relative interest rates in EMs naturally attract foreign investment in interest-bearing assets such as bonds and deposits with banks Whereas stronger economic growth has traditionally drawn investors to equity investment and spurred greater foreign direct investment (FDI) on prospects of higher future profitability,” QNB said.

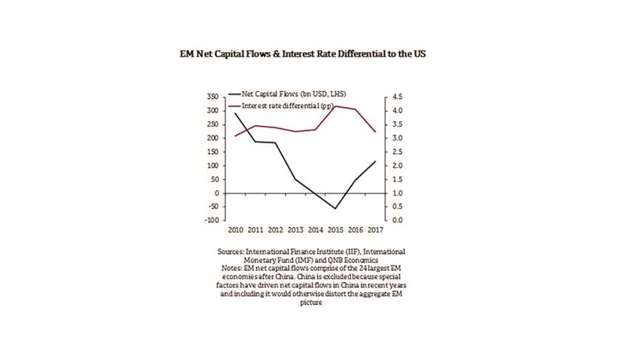

Since the global financial crisis, EM capital flows have been mainly determined by relative growth rates rather than relative interest rates. Net capital flows to EMs declined in 2010-15, but then recovered in 2016-17.

Over the whole period, interest rate differentials between EMs and the US remained broadly stable, even rising as net flows turned negative in 2015.

Meanwhile, EM growth differentials have moved in line with capital flows. As the growth differential declined in 2010-15, net flows to EMs also fell, this then reversed in 2016-17, QNB said.

This finding has been widely corroborated by the economic research literature on EM capital flows. Estimates reveal that EM capital flows have become more than 1.5 times more responsive to relative growth than relative interest rates over the past two years. Moreover, the impact of a change in relative interest rates on capital inflows has diminished by around 13% compared to the pre-crisis period of 2005 to 2008 whereas the capital flow sensitivity to relative growth has remained about the same, it said.

“While less important that relative growth rates, interest rate differentials between EMs and the US have still been supportive of capital flows to EMs. Central banks in both advanced and EM economies cut rates to historical lows in the wake of the financial crisis and rates were kept low until 2015 when the US began to normalise policy,” QNB said.

EM central banks have been hiking rates since 2015 for a variety of reasons. Some were responding to the Fed while others were trying to support their currencies and mitigate against capital outflows as a result of commodity price shocks, political risks or other external pressures.

As a result, the interest rate differential relative to the US remained generally stable over the post-crisis period, maintaining the attractiveness of EM interest-bearing assets to foreign investors. Considering the consensus view that EM growth will accelerate faster than US growth in 2018, QNB expects that net capital flows will continue to increase and more than offset any impact of less favourable interest rate differentials.

“While faster Fed normalisation will pose a headwind, it is also possible that some EM policymakers could respond to offset higher Fed rates as they have done in the past. All in all, the market mood around higher rates is unlikely to perturb EM investors. If growth holds up as expected, capital flows should follow suit,” QNB noted.