Oman raised $6.5bn from a bond offering as the Middle East’s biggest non-Opec producer seeks to bridge a budget deficit.

The country sold $1.25bn of five-year notes priced to yield 190 basis points above similar maturity US Treasuries, said a person familiar with the transaction. It also placed $2.5bn of 10-year bonds at a spread of 310 basis points over Treasuries and $2.75bn of 30-year bonds at a spread of 395 basis points.

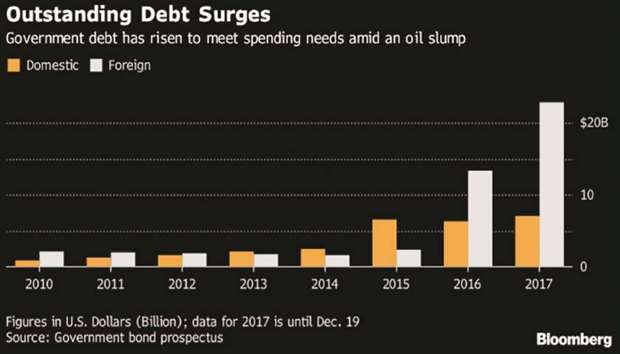

Oman last year raised $7bn from two bond sales as it sought to bridge a budget deficit brought on by lower oil prices. The country expects to sell $7.5bn in 2018 to help meet spending requirements, which will push the ratio of government debt to economic output to 50.8% this year from 15.3% in 2015, according to data from the International Monetary Fund.

The country’s bonds are rated junk by S&P Global Ratings. Moody’s Investors Service Ltd and Fitch Ratings Ltd classify Oman among the lowest investment grades with a negative outlook. The sultanate expects external debt to grow until 2020 and exceed its liquid financial assets for the first time.

Citigroup Inc, HSBC Holdings, JPMorgan Chase & Co, Standard Chartered and SMBC Nikko Securities Inc managed the sale.

Oman’s borrowing binge may increase the number of junk ratings linked to the sultanate.

The Middle East’s biggest non-Opec oil producer has lined up a triple-tranche dollar bond sale, potentially becoming the first developing nation to tap international capital markets in 2018. Oman may borrow $7.5bn this year, pushing its debt to economic output ratio to 50.8%. That’s on par with China and the Slovak Republic, and a far cry from the 15.3% ratio in 2015, data from the International Monetary Fund show.