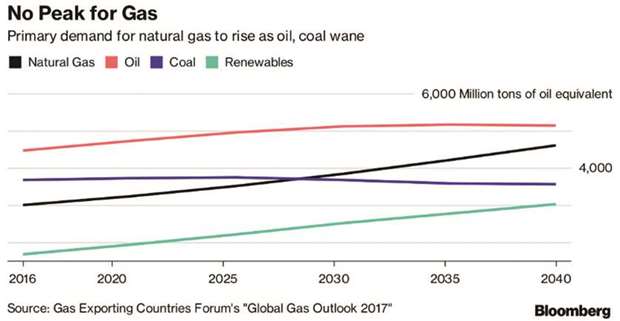

Demand for natural gas will continue to rise over the next two decades, stimulated by lower prices resulting from an expected surge in supplies of shale gas and other unconventional resources, according to the Gas Exporting Countries Forum.

Natural gas consumption will rise 53% by 2040, with demand catching up with supply in the next two or three years, the Doha-based group said last Thursday in its “Global Gas Outlook 2017” report. Growing extraction of shale, tight gas and coal-bed methane in the US and China will “dramatically increase natural gas demand over the outlook period,” it said. “This is mainly due to lower prices resulting from higher natural gas supplies.”

Gas markets have been transformed by the rise of US shale and Australian exports. These changes are expected to continue as unconventional resources almost double from 16% of gas supply today to more than 30% in 2040, according to the report. More supply has depressed prices while also spurring demand, a dynamic the GECF expects will re-balance the market by 2020.

“The growth of shale is good because more gas will contribute to the penetration of gas worldwide,” secretary general Seyed Mohammad Hossein Adeli said in an interview from GECF headquarters.

GECF members include Russia, Iran, Algeria and Qatar, the world’s largest producer and exporter of liquefied natural gas. China, India, Brazil, South Korea and Australia will lead the world in gas demand growth, with consumption rising in each country between 2.3% and 4.8% a year until 2040, according to the report. Consumption in Japan, the world’s biggest importer of LNG, will contract 0.3% a year over the period as nuclear reactors are reactivated and renewable sources are exploited.

The growth in demand globally will be underpinned not only by abundant gas supply and lower prices but also because the fuel is the most effective way to mitigate carbon emissions, Adeli said. In the past five years, gas prices have become competitive with renewables, he said. LNG has also made gas, previously delivered by pipeline, more available, according to Adeli.

Power generation will continue to drive demand growth, with annual consumption expected to increase from 1,280bn cubic metres in 2016 to 2,329bn in 2040, while gas used in transport will jump from 138bn cubic metres to 347bn over the same period, according to the report.

.