A defiant Wall Street lifted most European stock markets off their lows yesterday, with investors shrugging off jitters over whether much-vaunted tax reforms in the US will actually be passed.

“US stocks are broadly rebounding from yesterday’s late-session slide despite flared-up uncertainty regarding tax reform’s ability to make it through Congress,” analysts at the Charles Schwab brokerage said.

But tax reform uncertainty was still hanging over markets like a dark cloud, putting a cap on investor confidence for the rest of the year.

“Until tax reform is signed off, end of year profit-taking and fear about a US government shutdown could impair the march to new records in stock markets,” cautioned Jasper Lawler, Head of Research at London Capital Group.

London’s benchmark FTSE 100 index nudged higher, as investors tracked an EU summit focussed on Britain’s departure from the European Union.

Accendo Markets analyst Mike van Dulken attributed the rise in the FTSE to “weakness in the pound as we take a step closer to Brexit”. EU leaders on Friday approved the opening of the next stage of Brexit talks after reaching a deal on divorce terms with Britain, EU President Donald Tusk said.

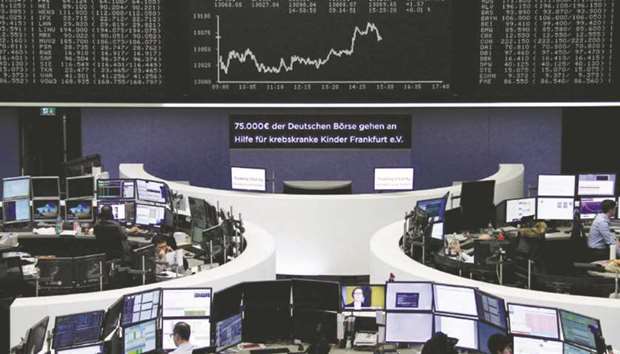

Frankfurt also managed small gains by the close, having traded lower for most of the session, but Paris ended slightly lower.

On Thursday, US Republican senator Marco Rubio was considering voting against a final tax-cut deal if certain demands were not met.

The warning comes as at least two other members of his party remain uncertain about how they will vote, putting its wafer-thin majority in peril.

The surprise loss of the Republicans’ once-safe Alabama seat this week has added to the sense of fear and once again raises questions about US President Donald Trump’s ability to push through his economic agenda.

Hopes he would introduce market-friendly measures such as tax cuts, infrastructure spending and deregulation helped fire a global rally this year, with all three main US indices hitting multiple records.

But Shane Chanel, equities and derivatives adviser at ASR Wealth Advisers, warned: “Markets are pricing a lot of optimism and usually only one thing happens when there is disappointing news.

“At these multiples, I believe that US markets are pricing in so much optimism that it doesn’t leave any room for error,” he said.

Greg McKenna, market strategist at AxiTrader, predicted that “things won’t get any easier in 2018 as candidates wonder about their electoral chances in the mid-term elections”. Tokyo ended 0.6% lower as the dollar fell against the yen on fading hopes for inflation-friendly tax cuts.

The fall came despite the Bank of Japan’s latest quarterly Tankan report showing Japan’s biggest manufacturers were the most confident they have been since 2006, as the world’s number three economy continues to improve.

Hong Kong sank 1.1%, Shanghai retreated 0.8% and Singapore lost 0.5%, while Sydney eased 0.2%.

In London, the FTSE 100 closed up 0.6% at 7,490.57 points; Paris — CAC 40 closed down 0.2% at 5,349.30 points and Frankfurt — DAX 30 ended up 0.3% at 13,103.56 points yesterday.

Traders work at the Frankfurt Stock Exchange. The DAX 30 closed up 0.3% to 13,103.56 points yesterday.