Gilt bulls may get a new reason to buy when UK Chancellor of the Exchequer Philip Hammond leans across the dispatch box to deliver his budget today.

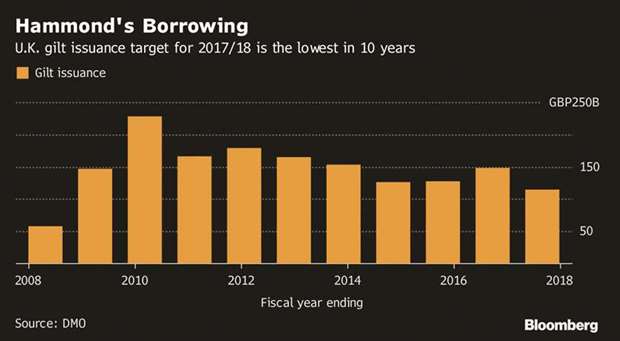

The Debt Management Office will cut £720mn ($955mn) from its £114.2bn-issuance target set out in March for the fiscal year 2017-2018, according to the median forecast of 11 primary dealers of the securities. While that equates to less than a typical auction, a drop in supply could add support to gilts – especially longer-dated ones – at a time when Brexit uncertainties are already fuelling demand for the safety of government debt.

The Office for Budget Responsibility may revise down its forecasts for productivity on the same day, a move that would suggest more pressure on the budget and increased borrowing in future years, but the market is unlikely to react to such concerns just yet, according to analysts.

“While we expect changes to gilt issuance in the near term to be minimal, the possibility of a larger cut” suggests risk-reward is skewed toward a rally on budget day, Nomura International strategists Andy Chaytor and Anne Karina Asbjorn wrote in a note to clients. Any downward revisions in productivity forecasts from the OBR “would mean notable upward revisions to the deficit forecasts further into the future.”

Ten-year gilt yields dropped 1 basis point to 1.28% in London, taking the month’s decline to five basis points.

Below is a roundup of analyst views on the budget:

Citigroup: The Chancellor is “constrained by self-imposed fiscal rules and low productivity making this budget more about the politics than economics,” Jamie Searle, a fixed-income strategist at Citi, writes in a note. For gilts, the immediate focus will be on any adjustments to issuance. We expect no change in gilt issuance for FY17-18.

The financing need may be slightly higher, but this can be met by adjusting Treasury bills (as is typical for in-year changes). There may be large revisions to future borrowing, but this has been well flagged. It is possible that the BoE MPC’s remit is changed from CPI to CPIH, which would be “net dovish in the current context”. The lasting impact from the budget might be political as “any signs of trouble would increase already-elevated political risk, providing support for long gilts into year-end”.

Deutsche Bank: A “stronger fiscal starting point is likely to be wiped out by downward revisions to productivity from the OBR, leaving the chancellor slightly less space in meeting his fiscal mandate,” write strategists including Oliver Harvey in a client note dated November 17. Still strategists “anticipate Hammond will spend at least some of what remains, in response to political pressure over austerity and in anticipation of slowing growth next year”.

Expect gilt issuance for the current fiscal year to remain at GBP114.2bn; contribution of T-bill financing to be revised lower by GBP3bn. With the public’s limited tolerance of austerity and Brexit likely hurting UK economic growth, Hammond “will choose to use some of his remaining war chest” which Deutsche assumes “will be front-loaded into 2018 and 2019, on top of announcements since March which amount to around 10bp of GDP”. Gilt market remains “expensive on a cross-market basis, with the market pricing a combination of continuing loose monetary policy and tight fiscal outlook”.

Nomura International: Of the total GBP11.5bn reduction in this year’s financing requirement Nomura predicts, gilt issuance will likely be cut by just GBP1.5bn (in 1Q next year), with T-bill issuance being marked down by around GBP10bn. Market reaction will depend on the “exact details of what Philip Hammond and the OBR announce and the consensus going into the budget,” writes Chaytor and Asbjorn. If the fiscal stance is left broadly unchanged then “we will more than likely retain our view of two hikes per year after today’s budget”.

NatWest markets: UK’s fiscal position continues “to look relatively poor, limiting the scope for discretionary stimulus measures,” write strategists at NatWest including Ross Walker, head of European economics. Chancellor may “take advantage of a GBP4bn over-fund, leaving the 2017-18 FY financing remit unchanged”. A GBP6bn upward revision to the 2018-19 FY gross financing projection could garner some attention, but compositional details of how this will be achieved will not be announced until closer to the end of the current fiscal year. So expect “a limited market impact on the day”. Do not expect the Chancellor to announce any changes to the BOE inflation target. After budget and inflation-linked index-events are out of the way, “expect the 10-year sector to act as an inflexion point on the curve – hold 1F1Y/5F5Y steepeners or 10s30s flatteners in gilts”.

Santander GCB: Expect the Chancellor to “reaffirm his commitment to achieving the primary fiscal goal, even as the pace of austerity is reduced,” writes Adam Dent, UK rates strategist. The lower-than-expected borrowing in 2016-2017 together with the higher than-forecast level of nominal GDP are crucial elements within our “gilt-friendly” expectations around the November budget.

Anticipated upward revisions to the borrowing projections will now start from a materially lower position than had been anticipated in the March budget, while the higher-than-expected level of nominal GDP should also expect this year’s gilt remit to be little changed. 2018-2019’s preliminary gilt target would be even lower than this year’s as a result, as the T-bill stock is built back up. This should provide a more significant gilts-supportive surprise than the contrary effect from any, widely-expected but still distant, increase in longer-term borrowing forecasts, some of which could come from further bill issuance.

Scotiabank: Gilt issuance seen unchanged at GBP114.2bn as “all of the reduction in the total financing requirement is accounted for by lower T-bill issuance,” according to strategist Daniela Russell and economist Alan Clarke at Scotiabank. Near-term, borrowing is “likely to be lower thanks to the windfall from better than expected tax receipts last year”. Longer term, borrowing is likely to be “higher owing to weaker productivity, weaker growth and some loosening of fiscal policy”. Expect a “gilt-friendly budget: unchanged 2017/18 supply, and very minimal changes to borrowing in future years”.

.