Emerging stocks and many currencies fell yesterday after a sell-off in South African assets over the mid-term budget compounded the prospect of higher borrowing costs and ahead of a key European Central Bank meeting.

South Africa’s local and external government bonds as well as the rand took another tumble after Finance Minister Malusi Gigaba painted a bleak outlook for the continent’s most industrialised economy in Wednesday’s mid-term budget speech.

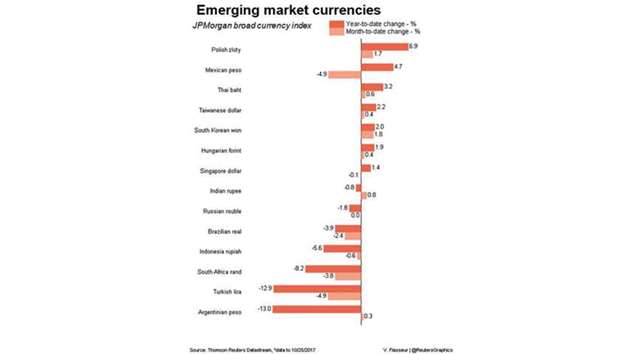

The rand traded around 1% weaker against the dollar following a 2% fall in the previous session with the currency on track for the biggest weekly fall since the surprise sacking of then-finance minister Pravin Gordhan in March.

“Yesterday’s poor budget data outlook, leading to almost 60% debt-to-GDP by 2020 is just a reality check for the years-long policy that has placed South Africa on a worse fiscal footing without any change for a population facing the worst income inequality/youth unemployment mix in the world,” Simon Quijano-Evans, emerging markets strategist at Legal & General Investment Management, wrote in a note to clients.

Assets in some large emerging markets such as South Africa and Turkey – both seen as vulnerable to US interest rate rises due to current account deficits – had already come under pressure from the prospect of higher borrowing costs as 10-year Treasury yields rose to a seven month high earlier in the week.

Turkey’s lira weakened 0.2% in its fifth straight session of losses as investors awaited a rate setting meeting by the central bank.

Policymakers are expected to keep key rates on hold.

However, the South Korean won rose to an eight-week high on bets that the central bank will raise interest rates soon after robust third-quarter economic growth, showing the economy grew at its fastest pace in seven years as geopolitical strains did not dent

trade.

Central and Eastern European currencies lost ground against a stronger euro ahead of the ECB meeting where it is all but certain to cut back on its bond-buying stimulus programme, its biggest step yet in unwinding years of loose monetary policy.

Late on Wednesday Brazil’s central bank cut the benchmark rate by 75 bps, slowing the pace of monetary easing but signalling it remained likely to cut interest rates to a record low next month.

Emerging stock markets lost ground, with the MSCI benchmark falling 0.3% to the lowest in two weeks following an overnight pull back in Wall Street.

Stocks in Russia and Turkey fell, while South Korea’s main index closed nearly half a per cent lower with investors taking profits after it hit successive record highs for four straight sessions.