New Zealand reminded currency traders this week of the power of politics to roil financial markets. The challenge is to figure out which world capital – from Tokyo to Washington – will deliver the next jolt.

The kiwi tumbled as much as 2% on Thursday and extended those losses yesterday as the opposition Labour Party won enough support in parliament to form a government, sparking concern among investors that the new coalition’s policies will slow the economy.

The New Zealand dollar, which is typically affected more by yield differentials and milk auctions, is the latest major currency to bear the brunt of unforeseen political developments.

Traders will now turn their focus to national elections in Japan, while monitoring the standoff over Catalonian independence and the risk of a US government shutdown before year-end.

“It’s only natural that foreign exchange is the first stop, because it’s the most liquid of all the key asset classes,” said Paresh Upadhyaya, a portfolio manager at Amundi Pioneer Asset Management, which oversees about $83bn. What’s more, “the hours are long – you can sell the kiwi any time during the day.”

The volatility emanating from Wellington came in a week in which contentious Nafta talks whipsawed the Mexican peso while the uncertain fate of Catalonia plagued the euro – thorny issues that weren’t widely anticipated at the start of the year.

And there are still plenty of events on the political calendar to keep investors on their toes, including: Japan’s October 22 election and the fate of Prime Minister Shinzo Abe’s economic programme.

Brexit negotiations, which have buffeted the pound. Tensions between the Spanish government and the Catalan separatist movement, which may undermine confidence in Europe’s common currency. The possibility of a US government shutdown in December that could trigger dollar selling.

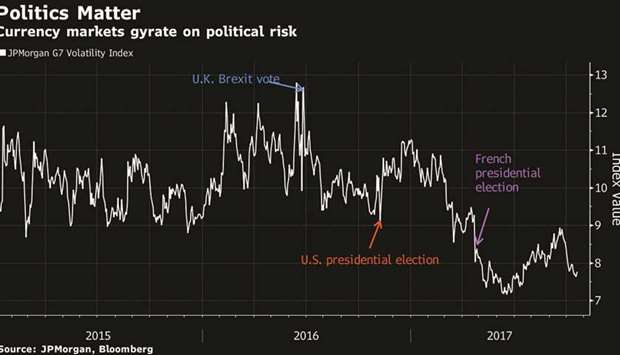

Traders are more keenly attuned to political developments after unpredictable events rocked markets in 2016. For starters, the UK’s vote in June to leave the European Union sent the pound plunging about 8% against the dollar that month. Then in November, Donald Trump’s surprise victory in the US presidential election helped propel the greenback to a 14-year high against the euro as investors anticipated economy-boosting stimulus.

While those shocks put market participants on high alert, landmark political events in 2017 didn’t necessarily serve as major catalysts.

In France, Emmanuel Macron’s election victory in May removed a cloud over the euro, helping it sustain a streak of monthly gains.

But in German national elections last month, while Chancellor Angela Merkel’s party may have emerged weakened, the euro slid less than 1% the day after the vote.

“My bottom line for political stories is that they can be important, but you have to really be able to draw a connection between the political outcome and meaningful change in fiscal or monetary policy or something else which is going to affect cross-border flows,” said Daniel Katzive, head of foreign-exchange strategy in North America at BNP Paribas SA.

Though the events in New Zealand may soon fade from currency traders’ minds, the lesson is clear: Don’t take your eye off the realm of politics.

“Brexit was a bit of a game-changer in that the markets really started to focus more closely on risk events,” said Amundi Pioneer’s Upadhyaya. “You’re seeing currency markets becoming more susceptible to positive and, in most cases, negative shocks.”

CURRENCY