India is likely to stick to its fiscal deficit target of 3.2% of GDP, and may accelerate sales of government stakes in lenders and other companies as part of an effort to recapitalise banks, an adviser to the prime minister said yesterday.

Prime Minister Narendra Modi’s government has already used up nearly all of its budget for the current fiscal year and tax revenues are expected to fall far short of initial expectations.

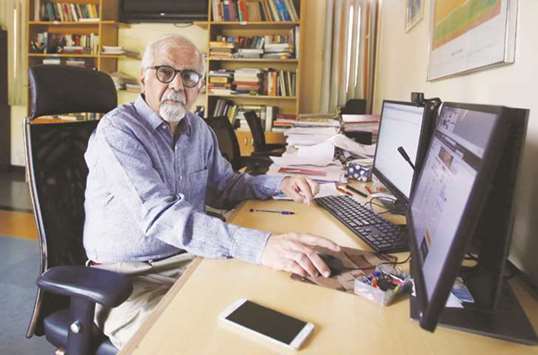

At the same time economic growth has slowed, sparking calls for more stimulus. But Surjit Bhalla, a member of Modi’s Economic Advisory Council, told Reuters in an interview, that the government had stuck to its fiscal deficit targets over the past three years and is expected to do so this year as well.

The central bank has warned that missing the fiscal deficit target could lead to a spike in inflation, hurting macro-economic stability. Indian stocks slid last month on reports that a stimulus package worth up to Rs500bn ($7.7bn) might be in works – one that would widen the deficit to 3.7% of GDP. Economic growth slipped to its lowest level in three years in the first quarter, logging an annual rate of 5.7%, but Bhalla said there were signs of recovery.

“I am more optimistic on the economy than I was two weeks ago,” he said, adding that last week’s industrial output and export data suggested fears about a slowdown were exaggerated.

Speaking at his home office in New Delhi, he said that GDP growth could be close to 6.5% for the fiscal year – although that forecast is lower than the central bank’s latest estimate of 6.7%.

Modi formed the Economic Advisory Council last month to address issues of macroeconomic importance and present its views to the prime minister.

Bhalla said the council’s views on the fiscal deficit has been communicated to the government by its chairman, Bibek Debroy.

Sour loans in India’s banking sector hit a record Rs9.5tn ($146bn) at the end of June with stressed loans as a percentage of total loans at 12.6% – the highest level in at least 15 years.

That represents a major problem for Asia’s third largest economy, as provisions eat into profits and new lending is choked off. The bulk of the sector’s bad loans are held by the country’s 21 state-run banks.

Asked how much it would take to recapitalise state-run banks, Bhalla said: “My reading is that it would probably require about Rs1tn ($15.4bn).”

In contrast, Moody’s expects the top 11 state lenders alone will need nearly $15bn, while Fitch Ratings estimates Indian banks will need $65bn of additional capital by March 2019 to meet Basel III global banking rules.

Bhalla added the government could speed up the sale of its stakes in state-run banks and other companies to fund the recapitalisation. The government has allocated $3bn in its budget for bank recapitalisation, but senior finance ministry officials say a decision on an infusion of more funds could be taken by end-December.

Bhalla: India is likely to stick to its fiscal deficit target of 3.2% of GDP, and may accelerate sales of government stakes in lenders and other companies as part of an effort to recapitalise banks.