Argentina’s equity markets are gaining momentum, with $3.5bn ready to go public as some of the country’s largest companies look to raise capital for the first time.

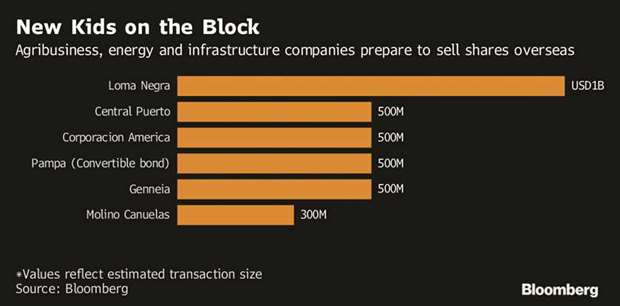

Cement-maker Loma Negra Cia Industrial Argentina and agribusiness group Molino Canuelas Sacifia are among a half-dozen companies working to sell shares overseas in the next six months. That would be the most equity-market debuts – and the greatest value – since at least 2007, when four firms raised a total of $1.6bn during the entire calendar year, according to data compiled by Bloomberg.

The planned stock offerings are following in the footsteps of Argentine corporate bond sales, which have amounted to $5.7bn in the international market this year. The equity pipeline solidified after President Mauricio Macri’s pro-market party made a strong showing in August’s mid-term primaries, making room for him to push through needed labor and tax changes. The results encouraged both companies and longer-term investors to bet on the country, said Sebastian Loketek, Bank of America’s head of Argentina, Uruguay and Paraguay, in an interview. The final vote is scheduled for October 22.

“I haven’t seen this level of enthusiasm for Argentina in a very long time,” said Loketek, whose bank leads equity issuance league tables for Argentina. “The appetite and investor base have increased substantially; before it was not that easy to make large deals happen because it was limited to some hedge funds that saw a great opportunity and were anchoring the deals. There was no leverage for the issuers. What’s changing after the primaries is we’re seeing long-only term equity players coming in larger size.”

Loma Negra’s offering may come before the elections as its parent company, Brazilian construction company Camargo Correa SA, wants to raise as much as $1bn to repay debt. Airport operator Corporacion America is also said to be looking to speed up an IPO of about $500mn as it sees favourable market conditions.

Other companies looking to float include electricity generator Central Puerto SA, which has hired banks for a sale, and Genneia SA, which is selecting banks. Pampa Energia SA also hired banks to sell $500mn of convertible bonds, the third issuance ever of securities that can become equity if desired.

“There’s huge potential in the oil and gas, agribusiness, banking and infrastructure sectors, which will seek to raise capital to fund their activities as the economy grows,” said Gabriel Martino, chief executive officer at HSBC Bank Argentina SA. “We’re optimistic that the midterm election results will lead to more cross-border transactions before year-end.”

While former President Cristina Fernandez de Kirchner squeezed past Macri’s candidate in the Buenos Aires province primaries, pollsters are forecasting she will lose on October 22. Investors are, as a result, betting that increased momentum from the midterms will allow Macri to continue his reform-driven agenda, which so far has included scrapping capital controls and settling a decade long battle with creditors.

“There was a substantial mood change on Argentina after the midterm primaries, versus the weeks that preceded them, as the results suggested continuity of the economic and political model the current administration is proposing,” said Javier Grana, head of Itau Unibanco Holding SA investment banking for Latin America, ex-Brazil, in an interview. “We continue to see good companies coming to market and trading well, and that’s a self-fulfilling circle motivating those that are weighing opening or increasing their capital.”

Four banks raised $2bn in overseas follow-on sales this year and Despegar.com marked the first initial public offering of the year, raising $332mn. Since Macri took office in December 2015, Grupo Supervielle SA snapped a two-year IPO drought in New York and Buenos Aires in May 2016, and confectioner Havanna Holding SA listed locally a month later.

.