Emerging markets extended gains yesterday, with equities rising half a per cent and sovereign dollar debt yields at a new three-year lows, underpinned by buoyant economic data worldwide and a dollar retreat.

The dollar and US Treasury yields slipping off multi-week highs also helped, while expectations of relatively slow policy tightening process by the the US Federal Reserve keeps money flowing into emerging market funds.

Average yield spreads on emerging sovereign bonds over US Treasuries was at 284 basis points (bps), the lowest level since September 2014, narrowing 56 bps since the start of the year.

“If US(Treasury) yields fail to move meaningfully higher, this momentum can drive EM spreads another 20-30 bps lower this year, beating all expectations when we started 2017,” Simon Quijano-Evans, emerging markets strategist at Legal & General Investment Management, told clients.

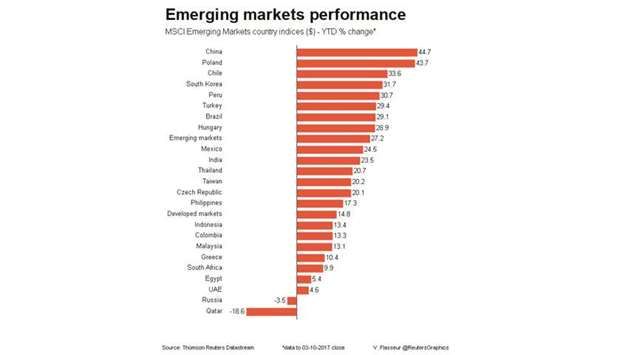

MSCI’s benchmark emerging stocks index rose 0.5% in a fourth straight day of gains, still supported by strong factory activity data from the world’s second largest economy China and emerging Europe, reflecting a broad export boom.

The Hong Kong bourse hit its highest since May 2015, up 0.6%, extending Tuesday’s 2.2% gains which were partly driven by China’s weekend decision to cut the amount of cash some banks must hold as reserves, boosting Chinese banks and insurers.

Chinese mainland markets are closed for a week-long holiday.

While economic growth is slowing, inflation is at a five-month high, threatening the bank’s target.

“Economic fundamentals suggest that there exists an easing bias in the monetary policy.

However, central bankers are likely to reserve some ammunition today, citing the reason of the recent pick-up in inflation,” Commerzbank wrote.

Indian 10-year yields stand just off four-month highs.

The Polish central bank is also likely to keep rates steady at a record low 1.5% and the zloty firmed 0.4% against the euro.

Liam Carson, emerging Europe economist at Capital noted that inflation had surprised to the upside last month and predicted inflation to breach the 2.5% target in early-2018.

“That should be enough to persuade some of the more dovish members to turn more hawkish and that will prompt the start of the tightening cycle,” he added.

The rouble strengthened 0.3%, helped by data showing Russia’s services sector hit a three-month high in September while South Africa’s rand firmed 0.4%, climbing off a six-month low hit on Tuesday.

The rand was helped up by dollar weakness, overshadowing data showing private sector activity shrinking at the fastest rate in 17 months.

.