Dana Gas bondholders, including BlackRock Inc and Goldman Sachs Group Inc, submitted a proposal to the Middle Eastern energy producer to resolve a dispute over a $700mn sukuk that shocked the Islamic finance industry this year.

A person close to the company said the terms aren’t acceptable.

The deal, which has support from over 70% of sukukholders, includes a cash pay-down of $300mn at par and a dual-listing of the company’s shares on the London Stock Exchange, the ad hoc committee of bondholders said in a statement. It also sought a maturity extension of three years.

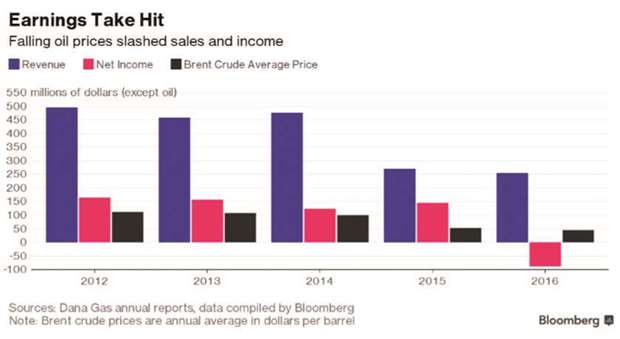

The proposal isn’t acceptable and the company is moving ahead with its litigation strategy in the UK and the UAE, a person close to Dana Gas said, declining to be identified because the person isn’t authorised to speak publicly. The Sharjah-based energy producer is seeking to restructure debt for the second time in five years as it struggles to recover payments from Egypt and Iraq’s Kurdish region. After announcing in June that its own facilities don’t comply with Shariah principles, the company offered to replace two outstanding sukuk with four-year bonds that pay less than half the current average 8% profit rate.

But it retracted that proposal on July 31, the day it missed a profit payment on its sukuk, in favour of a court settlement.

“We have always wished to negotiate a consensual restructuring of the sukuk, in response to the company’s request for an extension,” Andrew Wilkinson at Weil, Gotshal & Manges, which is advising the ad hoc committee, said in the statement. “We hope that Dana’s management sees this as a good proposal, which would deliver a stable capital structure going forward, enabling value creation for all stakeholders.”

.