A pullback in the shares of Apple component suppliers in Asia knocked emerging equities off a three-year high yesterday, but China’s yuan steadied after three days of losses.

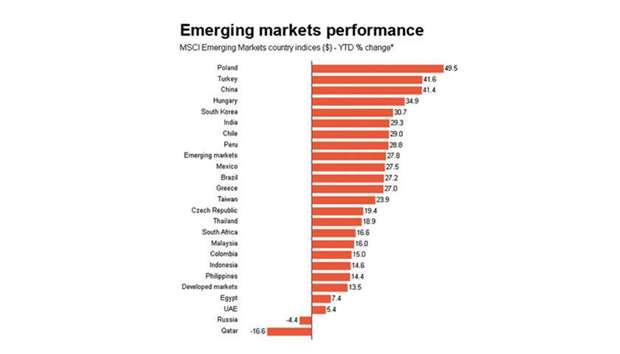

MSCI’s benchmark emerging equities index was down 0.1% with Asian manufacturing markets leading the losses after Apple disappointed by saying its new iPhone would ship later than expected.

Although Asian markets overall touched a fresh 10-year high, tracking record highs on Wall Street, several emerging market index heavyweights fell.

MSCI’s emerging tech index, the biggest part of the overall MSCI emerging market benchmark, retreated from record high after gaining almost 50% so far this year.

“Against the backdrop of Apple we are seeing a drop in the hardware and semiconductor subsectors, which make up some 40% of the EM IT sector,” said Peter Garnry, head of equity strategy at Saxo Bank in Stockholm.

“There is some retreat but there were very strong expectations leading up to the iPhone launch — even Apple shares have fallen — but we think that overall, the environment for IT stocks continues to be positive.”

Taiwan stocks dropped 0.7%, with shares of Apple supplier Taiwan Semiconductor Manufacturing Co, the world’s biggest contract chip maker, falling 0.5%, while Hon Hai Precision Industry slipped 1.3%. Hong Kong shares fell 0.3% whilst Chinese Apple-linked stocks such as Zhejiang Crystal Optech tumbled 6.7% and Goertek shed 3.6%. South Korean shares slipped 0.2%, weighed down also by lingering worries over tensions between the United States and nuclear-armed North Korea.

US President Donald Trump said the new sanctions agreed on North Korea were nothing compared to what would have to happen to deal with Pyongyang’s nuclear programme.

Secondary sanctions on Chinese banks are on hold to allow Beijing to show it will enforce the curbs. China’s yuan firmed after three straight sessions of losses, rising 0.1%, although the central bank fixed the yuan at a weaker midpoint.

Chinese mainland shares also traded up around 0.15%. South Africa’s rand was one of the biggest fallers, weakening 0.3% against the dollar.

On Tuesday, court papers showed that South Africa’s anti-graft watchdog had consulted President Jacob Zuma’s legal advisers on a proposal to change the central bank’s mandate.

The bank says this undermined the watchdog’s independence. The Polish zloty weakened 0.2% against the euro, whilst Polish shares also fell 0.2%. The European Union has given Poland one month to address concerns over a judiciary overhaul or face a court challenge.

Hungary’s forint slipped 0.15% against the euro and Budapest stocks fell 0.2%, with Hungary under pressure to implement a ruling by the EU’s top court to take in refugees.

Analysts at Societe Generale noted that inflows into emerging market assets had slowed, but any meaningful weakness in currencies should be viewed as a buying opportunity until there was a “tangible deterioration” in underlying fundamentals.

.