This summer, Japanese real estate investment trusts (REITs) benefited from an unexpected group of net buyers for the first time in nearly seven years: Mom and pop investors.

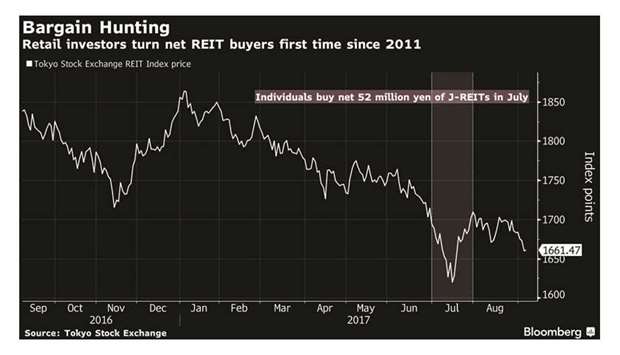

Encouraged by the relatively lucrative returns, an increasing number of retail investors are putting their money in some of 58 publicly-traded REITs tracked by the Tokyo Stock Exchange’s gauge. Individuals were net buyers in July for the first time since November 2011, according to TSE data. They invested a combined ¥52mn ($478,000), a turnaround that strategists say is likely to have continued in August.

While the size of investment is dwarfed by other financial institutions’ ¥8.7bn of net purchases, the increased presence of retail investors in a ¥10.4tn market that has traditionally been a place for institutions hints at the growing appetite for alternative investment vehicles among Japan’s citizens whose world-beating longevity means decades of retirement.

Seniors in their 70s accounted for 17% of total J-REIT investments by individuals for the year ended March, according to a survey conducted by IB Research & Consulting. That’s the highest proportion since it started compiling the data in 2012. People 60 years old or more accounted for 45% in total, according to the company.Hisashi Murakawa, 73, who’s been retired for 10 years following stints at a bank and a construction firm, is one of the growing ranks of senior REIT investors.

He now has half of his assets in REITs and the other half in equities. Nippon Building Fund, Nomura Real Estate Master Fund and Nippon Prologis REIT are among his 20 REIT investments that helped him achieve a 10% overall return last year.

“The government’s policy calls for people to move away from deposits to invest, but there hasn’t been an appropriate market for that,” Murakawa said in an interview. “REITs seem like a good place to be for those who don’t have investing experience.”

REITs allow retail investors to anticipate stable returns based on commercial real-estate holdings and prices are often more resilient to fluctuations in the global financial markets than equities or bonds.

The projected 12-month dividend yield for the Tokyo Stock Exchange REIT Index stood at 4.1% as of the end of August. That would be the highest since an average 4.6% return recorded in 2012, according to the Association for Real Estate Securitisation.

In comparison, Mitsubishi UFJ Financial Group, Japan’s largest bank, offers a rate of 0.001% on ordinary deposits at its main banking unit, as do its two biggest peers.

The appeal of J-REITs for institutional investors has been dissipating, on the other hand, as equity markets around the globe rallied on better growth prospects. Increased scrutiny from the Financial Services Agency on how local institutions manage REIT funds has also crimped their appetite. As a result, the TSE REIT Index slid to an 18-month low in July, pushing up yields, attracting individuals.

“A return of around 4%, say, is reason for individuals to invest in REITs,” said Atsuro Takemura, analyst at Morgan Stanley MUFG Securities Co. “Individuals will consider REITs as an investment they don’t have to be that worried about, while inflation expectations are dropping.”

Fading confidence in Prime Minister Shinzo Abe’s push to reinvigorate growth in the world’s third largest economy has served as a reason for some individual investors to pull their funds out of local equities, for alternative investments.

The Topix index is up 4.8% so far this year which compares with a 19% advance by the MSCI AC Asia Pacific Index. Even so, strategists including Takemura say it’s too early to jump to conclusions on whether yields will hold up and individual investors will remain net buyers, especially with a big initial public offering scheduled in September.

.