Emerging equities retreated from last week’s three-year highs yesterday after a North Korean missile test sapped Asia’s big bourses, though dollar weakness capped the losses, with China’s yuan approaching a one-year high.

North Korea made its first ballistic test over Japan, firing a missile that landed in the Pacific Ocean off the northern region of Hokkaido.

But after a sharp sell-off that took Seoul stocks down 1.6% and Hong Kong 0.4% lower, markets clawed back most of the losses, allowing the indexes to close just 0.2% and 0.14% down on the day.

Equities in China, North Korea’s economic ally, held at 20-month highs, boosted by robust company earnings and expectations of restructuring at state-owned firms.

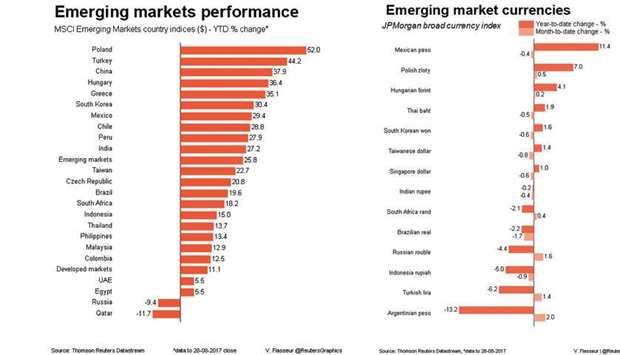

MSCI’s emerging equity index fell 0.5%, down more than 1% from last Friday’s highs.

Emerging market losses were, however, capped by a dollar sell-off which took the greenback to new 2-1/2-year lows against a basket of currencies. The won lost the most ground among currencies, falling 0.6% while other emerging currencies weakened only marginally.

“We saw a North Korea flashpoint a month or so ago when comments about Guam provoked a few days’ reaction...but markets don’t really know how to trade a one-in-50 chance of something happening, especially as they saw recently that the story failed to intensify,” said UBS strategist Manik Narain.

He was referring to an early-August war of words between Pyongyang and Washington DC, with the former threatening to attack the US territory of Guam.

The Chinese yuan continued a recent run of gains, heading for its strongest month against the dollar since a July 2005 revaluation.

The central bank midpoint was set at 6.6293 per dollar, the strongest since August 2016, while spot yuan traded at 6.6037, with local traders predicting the unit would breach the 6.6 level last seen in June 2016.

Narain contrasted recent yuan strength with its general weakness against partners’ currencies in the January-April period.

“Since May there has been a bit of regime change in the yuan.

It’s not just a dollar move, it seems like they made a calculated decision to take volatility out of dollar-yuan, possibly to appease US President Donald Trump and to keep capital outflows under a tight leash,” he added.

Morgan Stanley analysts said they held a long yuan position against the rand, citing a PBoC adviser’s view the currency could head towards 6.5 per dollar by year-end.

“The PBoC is displaying their confidence in having reverted depreciation expectations, stabilising interbank leverage while maintaining healthy macro conditions onshore,” Morgan Stanley said, adding it remained “constructive” on Beijing’s financial liberalisation reforms.

Elsewhere, Hungarian stocks, which hit record highs on Monday after a ratings outlook upgrade from S&P Global, slipped 0.9% while Polish stocks too eased off 15-month highs.

Regional currencies weakened against the euro.

The Israeli shekel was at a one-month high to the dollar before a central bank meeting that is expected to keep interest rates steady at 0.1%.

.