Nearly 30 world leaders had gathered in Beijing in May to discuss the Belt Road Initiative, which was first launched in 2013 and known as the ‘One Belt, One Road’ project at that time.

Now four years later, the first wave of projects is being implemented and China is courting more international support for the project.

“But there is still uncertainty about what exactly BRI is, what are its flagship projects and why China would embark on such an expansive project,” QNB said.

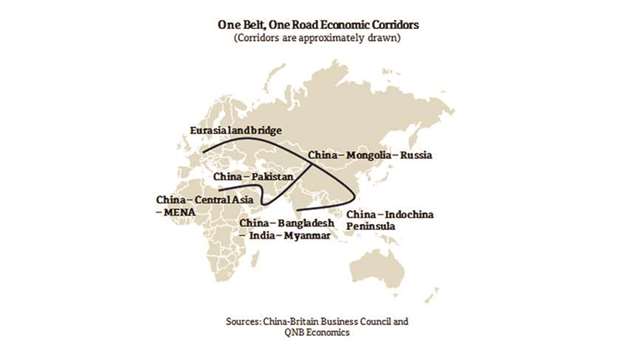

BRI is aimed at developing transport and energy-related infrastructure such as roads, railways, ports, and power plants along six so-called economic corridors connecting China to Central Asia and Europe by land and to India and Southeast Asia by sea.

Current plans suggest BRI projects would span across more than 60 countries which account for nearly a third of global GDP. To fund the BRI, China announced at its recent summit that it would spend $124bn on projects while it has previously made $890bn available in loans through its development and multilateral banks.

Overall, the full cost of BRI investments is estimated to be in the range of $1tn-$2tn but so far, just $35bn has been spent.

There are several major BRI projects. In Pakistan, China is leading the transformation of the southern port of Gwadar into an energy hub linking China to the Middle East. This involves road and pipeline networks stretching from Gwadar to western China, reducing a 12,000km journey to import hydrocarbons by sea to less than 3,000km over land.

Work on the road network and port expansion has already begun. Rail links between Tehran and China were established in 2016 and the Khorgos Gateway, a major cargo hub between China and Kazakhstan, is also operational and expected to be expanded under BRI.

There are other promising flagship projects that have not begun, QNB said. These include rail connections from Beijing to Moscow (7,000km) and southern China to Malaysia and Singapore (3,000km) as well as a deep sea port in Sri Lanka. QNB has cited three possible reasons as to why China might want to embark on such an ambitious and costly project.

First, slower growth in China’s domestic economy has led to excess production capacity, particularly in large-scale infrastructure development where Chinese firms have developed a particular expertise. BRI offers an avenue to export that productive capacity and technological know-how that could otherwise be a drag on its domestic economy.

Second, there remains a substantial surplus of domestic savings in China. Rebalancing towards consumption is occurring but not fast enough to materially reduce the savings glut. Policymakers could see outward investment into what is largely Chinese controlled and led projects as an important avenue to direct those savings.

Third, China should reap the benefits of greater trade flows. Of all the countries involved in BRI, Chinese exporters and trade-related sectors are likely to benefit the most. BRI will reduce transport costs, shorten delivery times and improve access in frontier and emerging markets. Moreover, it offers the opportunity to keep China in control of the flow of Asian trade, even if it is losing share to other Asian countries in terms of production as it moves up the manufacturing value chain and shifts to consumption-based economy.

QNB said, “There has truly been nothing like BRI in modern economic history, which is why its implementation will come with major challenges.” The sheer task of construction on the proposed scale of BRI could take several decades and this is to say nothing about how China might bring about coordination across 60 different countries.

Achieving the requisite level of return will also be extremely difficult as the investments are mainly long-term development projects rather than purely commercial ventures. Subpar returns could cause debt servicing issues in recipient countries and hurt investors and banks in China.

“In short, policymakers will need to be mindful of these risks. While the benefits of BRI could be immense, so could the costs,” QNB said.